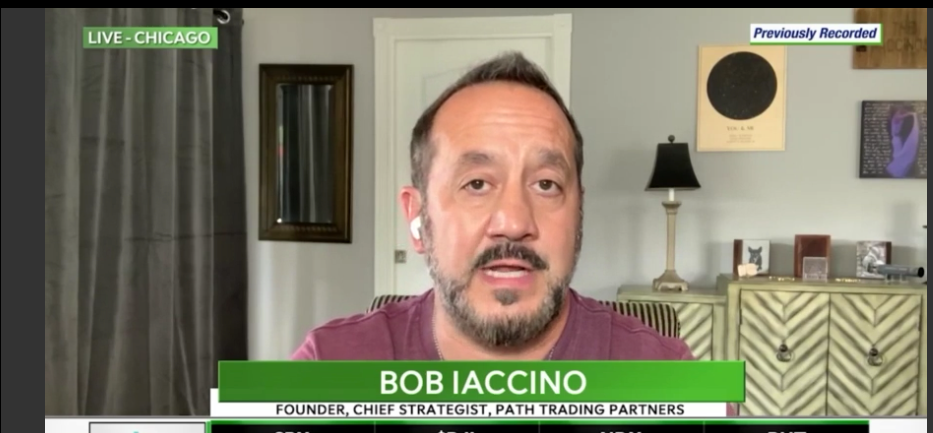

Oil supply could increase but that doesn’t necessarily mean lower prices in the short run, says Bob Iaccino, editor of the Stock Think Tank.

“We got our first refinery utilization number with an 83 handle on it since March 20th of last year,” he told TD Ameritrade in an interview.

“That’s the last time we had it above let’s say 82.8 and it was at around 87. If you looked the absolute price of where crude was that it was a lot lower than here, but that’s not really what you want to look at,” Iaccino said.

Rather, you want to look at oil relative to actual inventory, he said.

“And we’re basically flat in terms of gasoline inventory. We’re 2 percent above the five-year average in terms of crude oil inventory. So we’re still we’re tight. We’re tight versus the way that demand is growing,” he said.

Jet fuel demand is back to between 65 percent and 75 percent of record demand in 2019. But only about four gallons of that fuel comes from each 55 gallon barrel of crude.

“So that’s going to have a short-term effect on where supplies are at as well,” Iaccino said.

“They’re pumping crude oil out to get jet fuel and it’s not being used in gasoline, which is the main sort of product distillate that comes out of those barrels,” he explained. “You might start to see the inventories increase and it won’t necessarily be a bearish indicator.”

Price target

In terms of price, Iaccino says he is targeting $59.62 per barrel, though he is not currently long oil. “I’d still probably get out of those round numbers because they tend to work,” he said.

Nevertheless, the rapid changes in the number of new cases of Covid-19 and vaccination rollout on the upswing indicated the potential for a demand spike.

There a few factors to supply on the OPEC side, he said. “Number one is that they’re analyzing every month now whether they should up production. Saudi Arabia can reintroduce the million barrels that they decided to cut on their own pretty quickly.”