Thinking about college, career school or graduate school? If so, there is a lot to consider when it comes to getting ready for college, including how to secure financial aid.

College financial aid helps students and their families by covering higher education expenses, such as tuition and fees, room and board, books and supplies, and transportation.

As a father with a son getting ready to finish high school next year, I am looking at all the resources that can help besides personal family savings.

There are several types of financial aid:

• Grants

• Scholarships

• Loans

• Work-study and other programs

Families can usually get financial assistance through these four sources:

• Federal aid

• State aid

• Institutional aid

• Private agencies and foundations

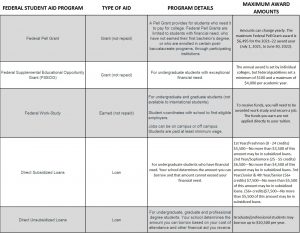

Listed below is a matrix of Federal Assistance:

The Free Application for Federal Student Aid (FAFSA) is the form you need to fill out to get any financial aid from the federal government to help pay for college.

Each year, more than 13 million students who file the FAFSA get more than $120 billion in grants, work-study, and low-interest loans from the U.S. Department of Education.

Colleges independently determine financial need by subtracting your expected family contribution (EFC) from the average cost of attendance at a college, which typically includes tuition and fees, room and board, materials such as textbooks and school supplies, and travel expenses.

The EFC is calculated in the Free Application for Federal Student Aid (FAFSA) and then used by colleges’ financial aid staff to determine how much financial aid you would receive if you were to attend their school.

When you fill out the FAFSA, you submit information about you and your family’s income and financial assets, as well as how much you and your family are expecting to contribute to your college tuition.

Choose wisely

Once you select the educational institution you are looking to attend, now you need to understand based on your financial situation how you are going to finance it.

Take time to understand the total cost of attendance, including tuition and fees, note, that most educational institutions raise prices every year. On average, tuition tends to increase about 8% per year.

An 8% college inflation rate means that the cost of college doubles every nine years.

Now you want to subtract the total amount of scholarships and grants you estimate that you will receive each year. How much can contribute each year? If you can’t save enough, it is time that you look into the loan as well as interest rates.

Lastly, look for additional ways to help pay it down such as a part-time job or possible military tuition assistance.

Try to control the amount of debt you are going to accumulate through school. Sure, it is a lot of fun to party and go on spring break. However, don’t let the banks and credit card companies tease you with credit card opportunities to later bite you when you graduate.

The last thing you want to have when you graduate is a big student loan debt and high-interest credit card payments when starting a new career. Remember, people don’t plan to fail, they fail to plan, so take time now to look at the big picture!