-

Lack of retirement tax planning is costly: Most retirees are unprepared or not prepared at all for the cost of taxes in retirement.

-

While many Americans will get Social Security tax-free, anyone with investment income or a pension could be taxed on their monthly check.

-

The key to better retirement tax planning is learning the strategies for regarding your 401(k), IRA, capital gains and home sales.

You might be looking forward to retirement — freedom from deadlines and work concerns. But retirement tax planning is hugely important.

Taxes stay with you until your dying day. And they might even get more complicated than while you were working.

Most 21st century seniors nevertheless enter their golden years underprepared for the effect of taxes on their retirement savings.

According to a 2014 study, 36% of retirees said taxes cost them more than they had planned for. A surprising 23% admitted that they had not done any retirement tax planning at all.

Planning adequately for minimizing taxes can help to keep you living comfortably in retirement. But there are several things to consider, including your age, your retirement accounts, additional investments, and Social Security.

Understanding how all of these work in advance can help you make plans for a comfortable retirement.

To make it a little easier, here’s an overview of the key of the three areas which most retirees are concerned with: Social Security, investment taxes, and taxes on selling your home.

In addition, we’ll discuss three ways to reduce retirement taxes that you might not be aware of.

Social Security retirement tax planning

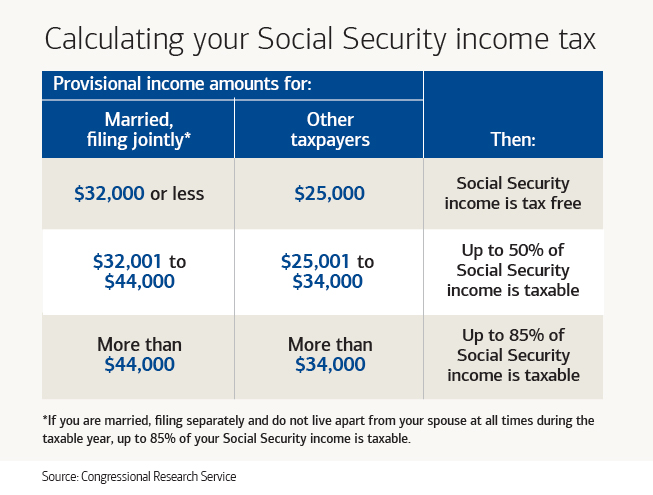

Depending on your income, you may have to pay tax on Social Security income checks.

The amount of tax you pay on Social Security depends on what the IRS calls “provisional income.” That includes gross income, half of your Social Security benefit, and tax-free interest.

If the sum of your provisional income is more than $25,000 as an individual ($32,000 as a married couple), income tax is due on half of your Social Security benefit.

If your provisional income is greater than $34,000 ($44,000 for couples), then you will need to pay income tax on up to 85% of Social Security benefit.

If you are low-income, say your only source of income is Social Security, then you usually won’t have to pay income tax on the benefit.

This will be the case for most people who live solely on Social Security. The average Social Security payment to retired workers was $1,411 in March 2018, or $16,932 for the year. That’s considerably lower than the individual tax threshold of $25,000.

Even if you fall in to the higher tax bracket you can still minimize the amount of tax you have to pay by following a few key tips.

Manage taxable income: Pension payments, dividends and interest from savings and investments, work earnings and withdrawals from 401(k)s and IRAs are all income. Finding tax-advantaged investment in retirement is important, as well as good retirement tax planning in advance.

Reducing expenses can help cut your taxable income, too. By withdrawing less, you end up in a lower tax bracket.

Take IRA withdrawals before Social Security: If you withdraw money from your traditional 401(k) or IRA in the years leading up to retirement, then you may be able to minimize your Social Security tax.

Simply changing the order in which you tap savings for income can can reduce taxes on Social Security later.

“Many middle income retirees should consider withdrawing their IRA account first before starting Social Security. This reduces their IRA account balance by the time required minimum distributions start, and many times the amount of Social Security taxes that typically increase as retirees withdraw more IRA money at the age of 70 and beyond,” said William Meyer, founder of retirement planning firm Social Security Solutions.

Factor in state taxes: Most states don’t tax Social Security income, but there are 13 states that do. They often have different policies regarding low-income retirees.

Investment earnings retirement tax planning

Your tax rate on investment earnings depends on both your income and how long you’ve owned the investment.

Short-term capital gains, which apply to investments held for one year or less, are taxed as ordinary income. Long-term capital gains on investments held for more than one year are taxed at a lower rate.

Short-term capital gains: Most of the time you will pay a higher tax rate on property or investments that you’ve owned less than a year. Short-term capital gains are usually taxed at the same rate as ordinary income. That’s generally between 10% and 39.6% of your profit (less losses on other investments per IRS guidelines).

Most people end up paying around 25%.

Long-term capital gains: Tax rates for long-term capital gains generally don’t exceed 20%, so if you wait for at least a year before selling it, then you will benefit from a lower tax rate.

Another way to minimize tax on investment assets is by waiting until your overall income drops before selling your most profitable investments. This is worth doing if you have short-term investments, as it could mean you pay less income tax and less capital gains tax.

If you expect your income to go down once you stop working, take advantage of that. Perhaps you’re changing jobs and know you will earn less in a given year. That could be a perfect time to offload some high-value assets.

The other thing to consider is taxes on the transference of your assets after your death.

Not selling your investments means not taking capital gains, which can protect inheritances, said Kevin Reardon, president of Shakespeare Wealth Management.

“Upon dying, every person receives a ‘step up’ in basis, thereby eliminating capital gains on appreciated assets. When someone passes away, the cost basis of an asset is raised to the market value at the time of death,” Reardon said.

“For older or sickly clients, it may make sense to defer taking capital gains until they pass. In a recent client situation, we saved [some clients] over $100,000 in taxes for the heirs by not selling appreciated securities.”

Home sales retirement tax planning

According to a 2016 survey by Jamie Hopkins, retirement income co-director at The American College for Financial Services, a full 83% of retirees would prefer to stay in the same place on retirement.

However, many people prefer to downsize, whether to free up equity, move abroad, or just for a change of scene. This transaction can create a tax bill, but one that can be minimized if properly planned for.

For example, if you have lived in the house for a minimum of two of the five years before you sell it, then you could be exempt from home sale profit from capital gains taxes, up to $250,000 as an individual, and up to $500,000 as a couple.

Above this amount, then profits will be taxed according to federal capital gains tax rates, which range from 0% to 20%.

If you took a home office deduction, rented out the house, or rented out individual rooms during the time of your home ownership, you might owe “depreciation recapture tax.” This can be added back to your income when you decide to sell.

You’ll pay a maximum rate of 25%, according to Mark Luscombe, principal analyst at Wolters Kluwer Tax & Accounting.

3 retirement tax planning strategies

Own Municipal Bonds: One of the most popular ways to generate tax-free passive income in retirement is to invest your savings in municipal bonds.

When you buy municipal bonds directly from an issuer, the money you provide is lent to governments and authorities for things like the construction of a new school, road expansions and other public works.

Municipal bond income is exempt from federal and state income taxes. Being tax-free makes for an attractive alternative to income from taxable corporate bonds or dividends from stocks.

If you have a choice between investing in corporate bonds and tax-free municipal bonds, consider the benefit of having no tax on that income in the context of your other tax obligations.

Muni bonds pay less yield, but often the tax gain makes them competitive.

If, for example, a corporate bonds yield 7%, and the tax-free municipal bonds yield 5% and you had $500,000 of funds to invest, then the corporate bonds would generate $35,000 in interest income each year for you to live on, but you would still have to pay income tax.

The income from tax-free municipal bonds would generate $25,000 per year. However, you wouldn’t need to pay any federal or state taxes on these bonds, so long as you investing in securities issued in your home state.

Everyone’s situation is different, so you need to calculate a figure known as the taxable-equivalent yield.

For most people, the less tax you pay, then the more you stand to benefit from investing in corporate bonds.

For those who pay higher taxes on income, then municipal bonds could be a favorable retirement tax planning alternative.

Do a Roth IRA conversion: Unlike traditional IRAs, there is no tax deduction for contributions to a Roth IRA, and earnings are also usually tax-free.

With Roth IRAs, investors agree to pay tax on deposit in exchange for tax-free treatment when funds are later withdrawn.

Investors who use Roth IRA need to defer making withdrawals until they reach at least age 59-and-a-half to achieve tax-free status.

Funds must stay invested for a minimum of five years. Withdrawing money can incur not only taxes on the money withdrawn but a 10% penalty.

Roth IRAs represent post-tax contributions, so converting to a Roth means undoing that deferral. This means you will need to pay tax on accumulated earnings and on savings contributions that you took a tax deduction on in previous years in order to convert the funds into post-tax money.

Calculating these tax costs can be tricky, but two things are essentially happening. The government is taxing the current value of the funds that you convert, and those funds become your basis in the new Roth IRA.

Accordingly, if the stock market were to decline significantly, that might be the best moment to convert and pay the taxes. Later, when the market rebounds, the Roth IRA balance is nevertheless tax-free forever.

If you decide you want to convert your savings, then you can do so from either a deductible or nondeductible IRA by getting in touch with your bank. Most financial institutions will offer both Roth IRA and IRA accounts so you can easily switch between them.

Avoid real estate gains tax: The term 1031 Exchange comes from the Internal Revenue Code that allows for the tax-deferred exchange of properties for different properties of a similar nature, hence they are also known as “like-kind” exchanges.

When a 1031 exchange occurs, sellers need to fill out Form 8824, and thereby realize no immediate capital gain or loss.

The seller will be taxed only when the replacement property is sold. By that time most investors will either be well into the retirement years and be in a lower tax bracket or will have passed away.

This makes 1031s a powerful estate planning tool for helping minimize loss of wealth as it passes between generations.

“This is one of the last goodies in real estate […] Our typical customer is the mom and pop who maybe inherited land many years ago and want to move unproductive land into income-producing property,” said Kelly Yates, an attorney in Seattle.

“We also see the phenomenon of people in their 40s and 50s looking ahead to retirement and looking to sell a property to buy a home in Florida that they can rent and maybe retire to someday.”

There are caveats, Yate says. In order to qualify for this retirement tax planning trick, you must exchange a property for a property of the same use, .e.g. an investment property for an investment property, or a rental for a rental, and if it’s a rental property, it cannot be used for more than 14 days out of the year, or 10 percent of the rental season.