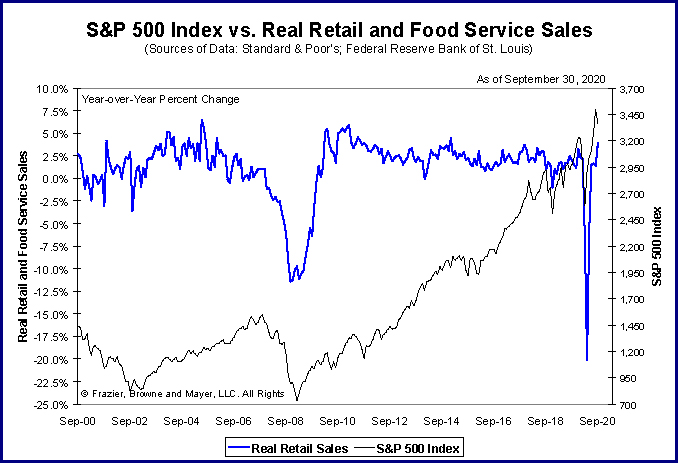

Data released today by the U.S. Department of Commerce indicate that sales at U.S. retail stores rose sharply during September.

Specifically, that data indicate that U.S. retail stores rose during September, on a seasonally-adjusted basis, by 1.7%, as compared to the prior month, and by 3.9%, as compared to the same month a year ago.

That’s the biggest pre-COVID-19 month-to-month increase in U.S. retail sales since September 2017 and the biggest year-over-year increase in the country’s retail sales since September 2011.

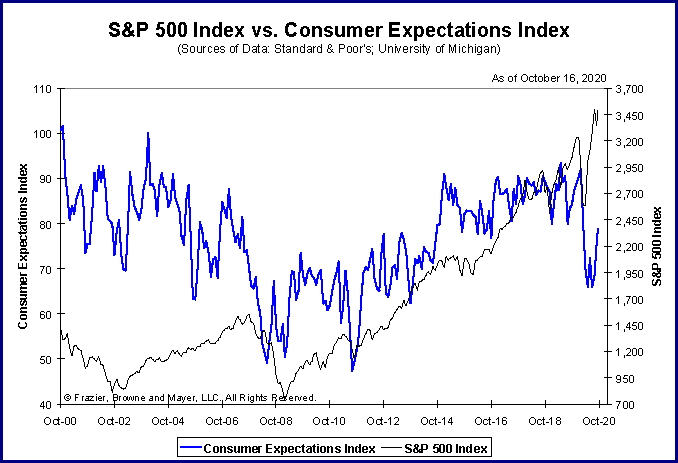

The University of Michigan announcing today that its early October survey of U.S. households indicates that the economic expectations of Americans also rose sharply during the first half of October.

As a result, there’s a good chance that sales at U.S. retail stores will continue to increase during the full month of October.

Because total personal spending in the United States is very highly correlated with the country’s retail sales, such a development would indicate that the total U.S. output of goods and services — its gross domestic product (GDP) — also continued to increase during October.

That would be a very positive development for the near-term future direction of U.S. stock prices, as publicly traded stocks of U.S. companies tend to move in the same direction as the country’s GDP.

As a result of the economic developments mentioned above, I expect U.S. stock prices, including the stocks that compose our Bulletproof Wealth Report model portfolio, to rally sharply over at least the next few days.

Click Here To Subscribe On A 100% Free-Trial Basis To The Bulletproof Wealth Report!