Social Security is a government program, so it is unnecessarily complicated. Working or retired? Married or divorced or both? Disabled? Private or public employer? All these factors affect your Social Security benefits and options.

The factor you can directly control, however, is the age you choose to claim your Social Security benefit after retiring.

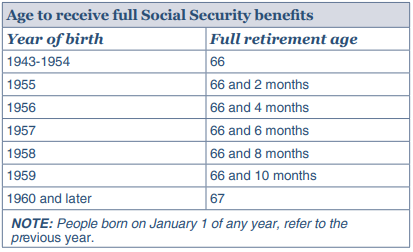

You can claim reduced benefits as early as age 62. Full benefits can be claimed at full retirement age, which is 66 if born in 1954 and rises to 67 for those born in 1960 or later.

Benefits claimed at age 62 for a retiree born in 1960 are 30% less than if claimed at full retirement age. However, if claimed at 62, by age 67 you would have already received benefits for five years.

Breakeven point

Is it better to receive 30% less but for an extra five years? The simple breakeven point is the age at which the higher payments catch up with the lower for longer payments.

In this case, it would not be until age 78 that the higher benefits from claiming at 67 catch up to the extra five years for claiming at 62.

Waiting to claim benefits until age 70 increases the benefit by 24% above the age 67 benefit. However, the breakeven now moves out to age 80.

Life expectancy is the key here. The life expectancy for a man at age 62 is 83 and 86 for a woman. If you live beyond these simple breakeven ages you would be better off delaying the benefits.

We do not know this in advance, though, and there is something to be said for grabbing the money while you can.

The simple breakeven point, however, does not account for the time value of money. There is an opportunity cost in delaying benefits. Retirees depend on savings, Social Security and perhaps a pension to cover retirement living expenses.

Claiming benefits at age 62 would decrease the amount the retiree would need to withdraw from savings to cover expenses. The opportunity cost is the future investment gains renounced by withdrawing money from invested savings.

Another way to look at the same situation is that the retiree could claim the benefit at 62 and invest the monthly payment rather than spend it. We invest because we expect positive returns over time.

The monthly investment would grow over time to an amount higher than the simple sum of the payments.

Opportunity cost

The extra five years of benefit payments, growing with a positive investment return, would push out the breakeven point further.

For example, a 5% annual return would push the breakeven age out to 88 which is five years beyond life expectancy for a man. Compared to claiming benefits at age 70, the same analysis gives a similar breakeven age of 89.

By claiming benefits at age 62, you get more money sooner. That’s a win. A 7% investment return pushes the breakeven age past 100.

This analysis depends on two elements we can influence, but not control: longevity and investment returns. If you think you will win the longevity sweepstakes, claiming guaranteed higher benefits later looks better and better the longer you expect to live.

Conversely, if you are confident about positive investment gains in the years to come, you should keep your savings working for you by starting your Social Security benefit early.

Now back to the unnecessarily complicated government program. For married couples with significantly different income histories or age differences, spouse and survivor benefits options would change how longevity is considered, but the opportunity cost component remains relevant.