If you are like most Americans, you have started shopping online more and more.

But online shopping isn’t just limited to food deliveries, grocery shopping, or clothing. About 36% of all cars purchased in the U.S. are purchased online, and a whopping 86% of car shoppers start their search online.

About 15 years ago, before vehicle shopping was as available as it is today, I was looking to purchase a car. We needed another vehicle, so we went looking for a car and I was extremely impressed with, the Cadillac CTS-V Coupe.

It was fast, sleek, and fuel-efficient. But I couldn’t afford a new one, so I was looking at two or three-year-old vehicles so that I could fit it into my budget.

In the process of looking at the cars on the lot, the salesman unwittingly talked me out of buying a car completely! He tried to talk me out of the Cadillac and into a Taurus by telling me about the cost of ownership.

Like most people, the first thing I looked at was price. How much car can I afford and what features are included?

Ofcourse, how much you can afford definitely factors into the decision, but the salesman got me thinking — what about the cost of ownership?

Comparing vehicle costs

For example, let’s say you can afford and want a 2020 Cadillac Escalade. Along with the perceived prestige of owning one, there are other factors that should be taken into account.

There are times when paying for high quality is worth it. A good, quality car will last, making your cost of ownership fall over time. But that isn’t always the case.

Something that costs more isn’t always better made. The base model Cadillac Escalade has an MSRP of $76,000, according to vehicle comparison site Edmunds.com.

The Escalade is a good car with loads of room for the kids or cargo. It gets 17 miles per gallon, which isn’t bad for a full-sized SUV, and it has some genuinely nice features.

But, what about the 2020 Chevy Tahoe? At just under $47,000 MSRP it is a little under half the price with similar features, cargo space, and fuel mileage.

Yet the manufacturer’s suggested retail price isn’t the only difference. Even though the Tahoe isn’t as prestigious as the Escalade, the cost to the owner is an estimated $62,176 on average over a five-year period, reports car comparison site KBB.com.

In comparison, the cost of owning the Escalade is a whopping $95,542 over those same five year period. Based on just the price of the car you would spend enough owning to purchase another car outright.

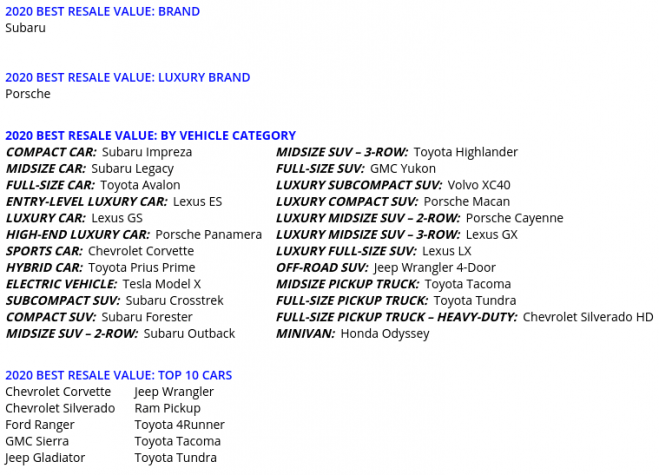

2020 Best Retained Value by Vehicle

The cost of ownership numbers includes the depreciation of the vehicle. For the Escalade, a little over half of the cost of ownership is lost through depreciation at $57,500.

The Tahoe, at half of the cost of the Escalade, loses just $31,500 in depreciation. Also included in the cost of ownership are out of pocket expenses that include fuel, insurance, financing, state fees, maintenance, and repairs.

If you live in a state with sales tax, you will spend 39% more just in taxes. Of all these expenses, only maintenance is about the same for both cars, which makes sense since each vehicle is manufactured by basically the same company. The Tahoe is also the lowest cost to own amongst full-size SUVs.

This isn’t an advertisement for the Tahoe, but rather just a side-by-side comparison example. You can do this for the Ford Explorer versus the Lincoln Navigator. You can do this for any make, model, and size of the car.

In fact, Edmunds.com has an online calculator that allows you to head-to-head compare any car you want. It’s based on a common set of assumptions, which are:

- Ownership expenses are estimated for a five-year period

- You will drive 15,000 miles per year

- You are financing the vehicle using traditional financing, not lease financing

- You have an above-average credit rating for the purpose of determining your finance rate

- You are making a 10% down payment on the vehicle at purchase

- Your loan term is 60 months

Next time you car shop, consider taking the savings from the lower cost of ownership and put it toward investments. You might just earn back some of that 50% depreciation.