-

The weakness in the stock market has reached liquidation levels, where high-quality names are being sold off along with low-quality companies — time to make your shopping list

-

Further stock market weakness is likely despite the recent rally, so buyers should remain patient and selective

-

Interest rates have declined and are likely to decline further, creating a secular tailwind for yield-payer.

Everyone knows you don’t throw out the baby with the bathwater. But, stock market investors do it all the time.

When market conditions get bearish, the newsflow gets panicky, and stocks start plunging, investors and traders will often find themselves exiting good stocks at depressed prices.

And investors and traders who can control their emotions during this period and preserve buying power can take advantage of their frenzied states.

This is even more commonplace today with the popularity of indexing and passive strategies. When indexes are sold, individual stocks within are also sold. This can feed into a negative cascade of falling prices, escalating fear, and margin calls.

Bear markets and market crashes only end when everyone is spooked and overleveraged traders and weak holders are shaken out. There are less investors out there willing to support a stock at certain prices regardless of what is going on in the market.

Today’s investors are even more herd-like, creating more risks and opportunities.

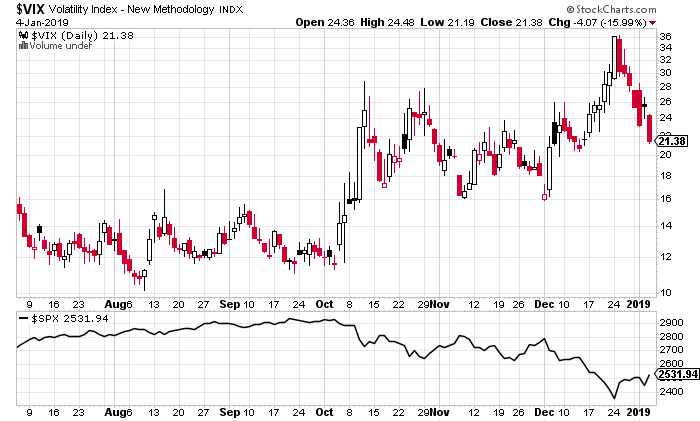

Many indicators show that the stock market has hit extreme levels of panic which have corresponded to meaningful inflection points. This can be seen in measures like the VIX, the put/call ratio and other survey-based sentiment readings:

Many active traders are saying the December 24th low is the bottom. There is some evidence to support this argument.

The S&P 500 has rallied 7.6% from these oversold conditions. Extreme bearish sentiment has receded. There are signs of strong accumulation and breadth which are similar to previous bottoms. Certainly, the indicators above and sentiment readings are signalling a capitulation.

However, while all these are necessary ingredients for a bottom, they are not sufficient.

Sufficient is an improvement in market conditions, bullish price action confirmed by improving fundamentals, and higher highs and higher lows.

So far, these have not materialized in this two week old rally. If they do materialize, I would be willing to change my stance and buy into the rally even at higher price levels.

Until then, my inner investor is going to continue to stalk high-quality stocks with high-quality setups. My inner trader is going to watch the market for low-risk opportunities on the short side for when the primary trend reasserts itself.

These types of market dislocations involve multiple capitulations.

Ideally, the stocks we are tracking should begin to diverge from the overall market’s price actin by making higher lows while the stock market makes lower lows. This is a rudimentary method to create a list of stocks with strong fundamentals and institutional demand.

A list of stocks that made higher lows in March 2009 vs January 2009 includes Amazon.com, Netflix, Green Mountain Coffee, and other big winners in the subsequent bull market.

Similarly, higher lows in February 2016 vs January 2016 yielded some of the biggest winners in commodity, energy, and industrial stocks until the uptrend exhausted itself in January 2018.

Opportunity in dividend stocks

Given the state of the market and economic trends, I believe that high-quality dividend stocks will begin to show signs of accumulation and higher lows.

Below is a five-year weekly chart of SDY, the S&P Dividend ETF:

Notice the slight divergences in August 2015, January 2016, and February 2016 against the broader market. This is also evident in the market’s successful retest of its January 2018 lows in April 2018 with the dividend ETF staying well above its lows.

Now contrast that healthy, constructive price action with this market. There are no meaningful divergences which would signal any sort of accumulation. SDY has made lower lows with the S&P 500.

While this behavior points to a more challenging short-term period, investors should be encouraged that better opportunities will likely emerge.

While the price action remains messy, the fundamentals have begun to improve. The Fed has signalled that it is paying attention to what financial markets are saying.

This is despite continued evidence that shows the economy remains strong despite challenges related to trade and political uncertainty. This combination of a steady economy and dovish Fed are two major tailwinds for dividend stocks.

The firm economy ensures that companies revenues will remain stable, while falling interest rates makes their dividends more attractive. Typically, the risk of falling interest rates is that it happens when the economy is lousy. The current climate is a goldilocks scenario for dividend stocks.

In fact, companies with strong balance sheets will be able to refinance debt at lower rates and augment share buybacks, both activities which will drive up earnings per share and share prices.

Trade ideas

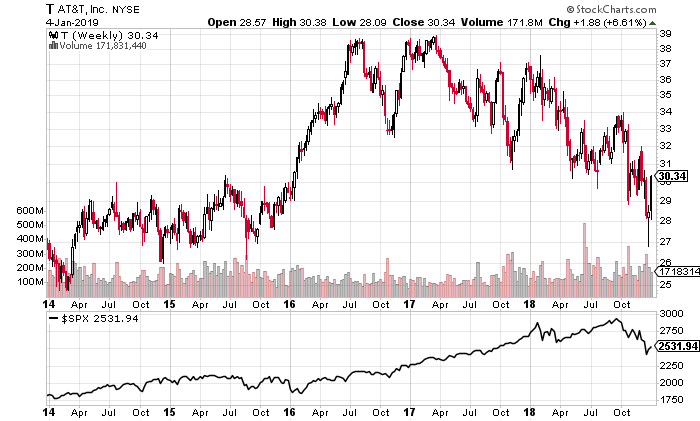

AT&T with a 6.7% dividend is interesting. The stock is almost 10% off its lows on December 24. It’s been a serial underperformer since mid-2016. Some reasons include rising interest rates, increasing risk appetites which made the sector out-of-favor, and questions about the company’s strategy.

However, the company has a strong franchise and seems to have successfully digested recent acquisitions as it has a forward price to earnings ratio of eight and earnings growth close to 30% with 15% revenue growth relative to the same quarter last year.

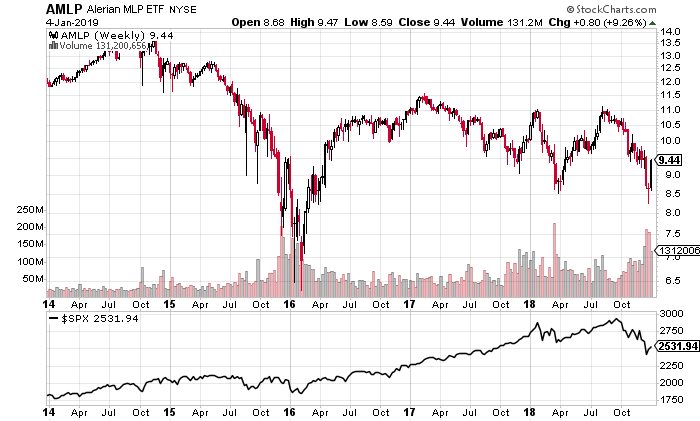

The Alerian MLP ETF is for anyone who wants to earn a 7.2% yield while betting on upside in energy prices.

This sector has been crushed by the dual forces of falling energy and higher interest rates. The Fed taking a pause will be reflationary for all asset prices while also resulting in AMLP’s dividend becoming more desirable.

To sum up, the broad market continues to be messy, and long-term investors need to exercise patience.

However, economic conditions are beginning to significantly improve for dividend-paying stocks.

Investors should wait for price action to confirm this improvement and start drawing up their personal list of high-quality dividend stocks, they would like to accumulate.