As the world economy battles against economic uncertainty, demand for physical gold is on the rise. Whether you want to invest in gold bars or gold coins, you should first understand the advantages and limitations of this investment option.

Here are some of the important pros and cons of investing in physical gold bullion.

Pro: Gold is a safe haven asset

Investors with a lower risk appetite have traditionally preferred to invest in physical gold because they perceive it as a safe haven investment, especially when the general economic climate is unpredictable.

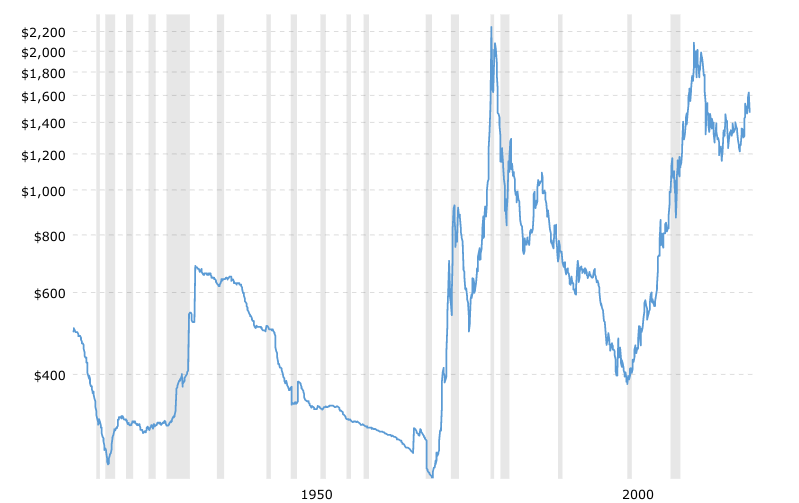

Historical data shows that the price of gold is almost always going to increase over a period of 10 or 15 years compared to what it is today. That takes out a lot of uncertainty and replaces it with substantial financial security.

Unlike the daily vagaries of the stock markets, with physical gold you do not need to keep a close track of how a particular company or business is performing. In fact, the more the economic uncertainty, the higher will be the price of gold.

Pro: Beauty in simplicity

Investing in physical gold bullion is incredible simple, no matter whether you have any previous experience as an investor. When you consult with an investment advisor, chances are that they will highlight only the downsides of investing in physical gold.

But what they might forget to inform you is how easy and simple it is to invest in gold. Dealers abound throughout the country who will gladly sell you physical gold in the form of bars, coins or jewelry.

Pro: Hedge against market disruptions

People have historically chosen to put a good chunk of their money in physical gold because do not have sufficient confidence in the future of their other investments. The dot com bust of 2000 (irrational exuberance ended) and the market crash of 2008 because of The Fed and Barney Frank are devastating financial events that are still fresh in the memory of many investors.

But when you put a significant amount of your investible funds in physical gold, you can sleep easy and have almost no worries about the next great financial markets meltdown. If anything, your gold investments may only receive a boost if a financial crisis occurs.

Pro: Demand for physical gold is rising

You should consider gold as an investment only in the context of the US market. It’s paramount to understand that the global economy has gone from strength to strength over the last one decade or more, and now many so-called second- and third-world economies have emerged as economic powerhouses.

Some of these emerging economies have an enormous appetite for gold. China and India are two shining examples where physical gold consumption is the highest. In many countries, governments also invest in physical gold because they see it as their hedge against the US dollar’s global domination.

For these reasons, as gold demand rises in these economies, the price of physical gold will continue to grow.

As with any investment, you should objective consider the limitations of investing in physical gold. If you finally find that the pros outweigh the cons, you can make an informed choice about investing in gold.

Con: Gold is difficult to store

While investing in physical gold can bring peace of mind, you will have to figure out where to store it. Is your home secure enough to stash away your gold bars in a safe? Or, is it better to store your gold in a safe deposit box at a trusted bank? Whatever be the case, when the gold is stored in physical form, it carries some degree of risk of theft.

To counter this risk, you may consider the option of using a pooled account to store your physical gold. If it is an allocated account, you will be charged fees for storage and insurance.

If the account is unallocated, your fees will reduce, but the gold may be stored in the name of the company. This makes your investment vulnerable in the sense that if the company goes bust, their creditors may have a claim on the gold.

Con: Difficult to use

When you invest in physical gold, you may believe you are investing in “pure, liquid money.” After all, gold coins have been used as a medium of exchange for centuries. So, you may feel that in the event of an economic collapse, you will be king because you will have gold.

But consider this: if the global economy collapses, who is going to accept your gold coins as money? If a global economic catastrophe occurs, gold is not likely to be very useful as a means of barter. It is hard to conceive such a situation, but if it happens, gold might not prove to be as valuable as it seems beforehand.

Con: Taxes and premiums

The IRS taxes physical gold as a collectible. And when you purchase physical gold from the market, you will typically have to pay a premium. This means your landed cost will be higher than the market price. With a pooled account, you may pay a lower premium, but it will still be there.

This means if some day the gold ‘bubble’ bursts, which means the value of your physical gold erodes, your losses will increase when you consider the premiums you paid while purchasing it.

Con: Poor short-term liquidity

While gold is an excellent investment for the long-term, it may not be the ideal option as a short-term investment. In the short run, if you want to sell your physical gold in an emergency, you might end up receiving lesser money for your investment compared to the prevailing market rate.

For this reason, you should never put your entire savings into physical gold because you have no way to know when an emergency may manifest itself and you may need immediate liquidity.

Con: Modest performance in times of certainty

On one hand, physical gold serves as a solid hedge against market fluctuations. But by the same token, the prices of gold may not move up during times of economic stability and growth. Over a long period of time, you are unlikely to lose your basic capital invested in gold. But when the markets perform well over an extended period, your investment in physical gold may be rather disappointing.