It has been well documented that much corporate debt has been downgraded by the rating services over the course of this pandemic slowdown.

However, the actual data shows it not occurring at quite the rate many had predicted at the start of this current slowdown. The data also shows that the level is not at overly extreme levels and certainly within historical ranges.

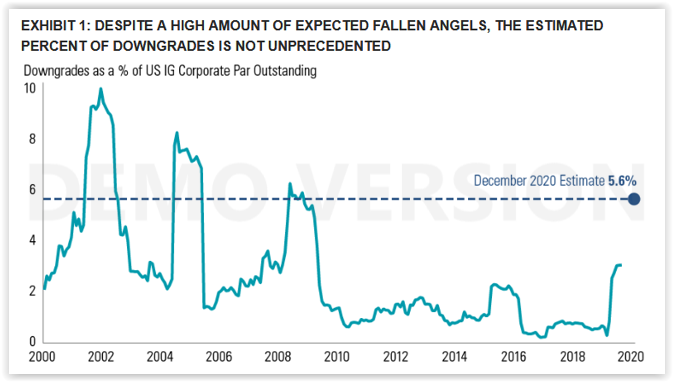

Refer to the chart below. It shows the percentage of all U.S. investment grade credit that has been downgraded to “junk” status, or a rating lower than BBB, going back to year 2000. This is what many analysts refer to as “fallen angel” debt.

Obviously, you can see the spike-up around the time of the COVID pandemic.

Some observations:

- This is coming off historically low levels of below at or below 1% from 20010-2019. The recent move up shown on the far right actually started moving up even before the beginning of the virus.

- Rising corporate debt in an environment of persistently low interest rates by itself caused a rise in fallen angels. This increase in corporate downgrades in recent months doesn’t move us into “off-the-charts” territory but well within historical ranges.

The provider of this data goes on to predict that the above percentage should rise up to 5.6% by the end of the year. This would amount to around $300 billion of corporate debt, roughly half of which has already been downgraded into junk status.

Doom and gloom?

Six months after the pandemic shut down activity in the United States very few large BBB-rated issuers have become fallen angels. Since the big draw-down in March, credit markets have generated strong returns, with the help of accommodating monetary policy, a better-than-expected corporate earnings backdrop, and high investor demand for yield and duration.

So, it’s not all doom and gloom in the world corporate debt downgrades and an increased level of fallen angel debt.

But it is certainly worth keeping an eye on. A sudden renewed downshift in the overall economy could cause the analysis presented above to look markedly worse.