Are we in in a stock market bubble? One major brokerage house recently published an in-depth report on this very topic.

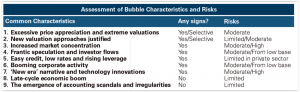

It looked at a multitude of previous stock market boom-turned-busts going all the way back to the “tulip mania” in Holland in the 1630s. The brokerage came up with a list of nine characteristics of market bubbles that are consistent hallmarks of market bubbles.

Without indulging you in the details of this report, their assessment of the current environment transposed on these nine hallmark characteristics are summarized below.

Five of the characteristics are a definite yes in the current market environment. Two of them, “Excessive price appreciation and extreme valuations” and “New valuation approaches justified” are a selective yes.

The selective labelling points to the bifurcation of the equity market. Many large cap growth, high duration stocks that were COVID stay-at-home beneficiaries last year took on valuation multiples much greater than those for the reflationary, reopening stocks that meaningfully lagged.

“Late-cycle economic boom” and “The emergence of accounting scandals and irregularities” are each a solid no in this study.

In fact, this, along with the selective labelling of the two characteristics above, leads the analysts of this study to conclude that we are not in the imminent stages of a stock market bubble waiting to burst.

I would also cite the overall manageable balance sheet leverage within the private sector, in contrast to the public sector, as an additional supporting factor that we are not at the doorstep of a stock market implosion.

The full takeaway from this study is that, to a degree, there are some indications that we are in a stock market bubble ready to break down.

However, there are some very important factors, such as where we are in the current economic cycle and the selective nature of high stock valuations, that indicate we just may have some time to continue to enjoy this market boom.