- Target-date funds (TDFs) provide an investment mix whose objectives vary over time.

- TDFs are marketed as a way to ensure risk is allocated appropriately.

- Risk-tolerance should be carefully reexamined against any fund’s investment objectives.

Introduced in the late 1990s, target-date funds (TDFs) were developed to provide those investors planning for retirement an easy way to adjust the investment mix in their portfolios as they approach retirement age.

For those individuals with no investment experience who were starting their careers, a target-date fund is a viable retirement savings vehicle.

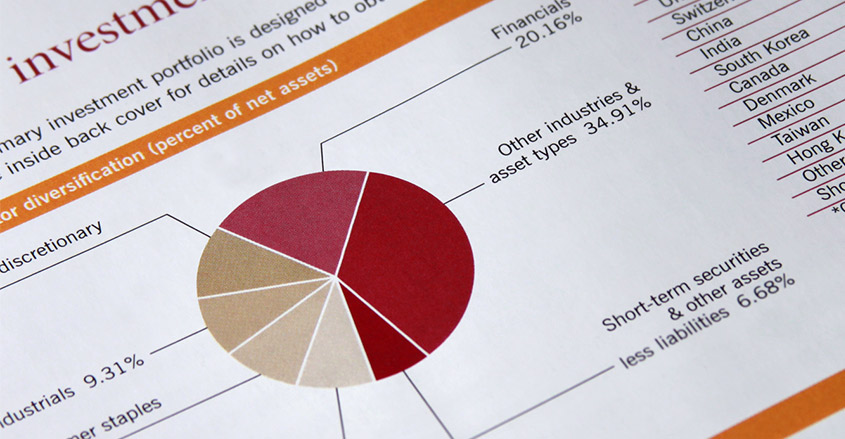

Target-date funds are funds that invest in other funds. They are designed to provide an overall investment mix of segregated mutual or index funds whose investment objectives vary over time.

A TDF is structured to automatically reallocate the bond-to-equity percentage weighting in a retirement account. The fund manager shifts the allocation between funds as an individual’s retirement approaches.

The purpose for the reallocation is to lessen the amount of investment risk assumed commensurate with the number of years to retirement.

The target-date funds are thus offered with specific dates in the future. For example, an individual planning to retire in 30 years would chose a TDF with “2050” in the name.

The strategy inherent in TDFs is to decrease the amount of stocks or other investments with higher risks at specified or targeted periods in the investors’ working years.

In general, the funds seek to provide the investor with as little risk as possible upon retirement, instead maximizing income generated by the fund through a heavier weighting in bonds.

These goals are realized by automatically shifting the investor into funds with a specified percentage of equities versus bonds or fixed-income investment vehicles.

During the early years of retirement planning, an investor can assume greater risk, with the potential for greater capital returns. As the planned retirement date draws near, the risk profile of the investor changes to more conservative, lower-risk investments.

Advantages of TDFs

One of the great benefits of choosing a TDF as a way to save for retirement is its simplicity. Individuals are relieved of the burden and worry of researching which investments over time would be the most suitable in terms of potential returns and risk assumed.

Many employees who have employer-provided 401(k) retirement savings accounts are notoriously inattentive in managing the swelling cash contributions made to their investment account. A qualified retirement plan that merely accumulates cash, however, is not going to provide a nest egg for retirement.

For individuals who completely overlook their retirement investments due to unfamiliarity or inexperience, a target-date fund can be a suitable option for retirement investing. Indeed, it is for these very reasons that TDFs are the default investment choice for employees who fail to select their own preferred funds from the available array of choices provided by the retirement plan sponsor.

The advantage of the TDF is that an expert fund manager selects the most appropriate investment mix for you so that your retirement account is fully invested in the right funds given the number of years until your retirement.

Asset allocation decisions can be fraught with risk. The task is thus best left to professional managers. An additional benefit is that TDFs can be purchased by investors for an individual retirement accounts (IRA) as well as taxable retirement accounts.

Disadvantages

While TDFs provide the convenience of automatic investment allocations at the appropriate time it is important to realize that, by its very structure, target-date funds are in many ways a “one size fits all” approach to retirement savings.

These vehicles are most suitable for those individuals who know how long they plan on working and have a fairly fixed date for retirement. Yet this standardization of a retirement savings plan many be ill-suited for some individuals.

Robert R. Johnson, professor of finance at Creighton University Heider College of Business in Omaha, Nebraska finds fault with TDFs for this very reason.

“Individuals are unique, and one parameter, the anticipated retirement date, cannot and should not dictate the appropriate asset-allocation mix and the change in that mix over time,” Johnson told the Wall Street Journal.

Inflexibility

Target-date funds don’t discriminate between individuals under the same fund roof. An investor with the same target retirement date as the fund may wish to have a greater exposure to risk than that for which the fund provides early in their career, so as to maximize their capital appreciation at that point in the investment life of the account.

This individual’s investment objectives would not necessarily mesh with the portfolio mix chosen by the fund manager at that particular point in time.

Also, an individual’s target retirement plans may change during the life of the TDF. A person whose original retirement date matched that of the retirement-year-denoted TDF may later decide to work part-time at retirement. That choice may impact Social Security payments and, hence, the person’s need for the amount of income the fund provides.

Fortunately, there are a plethora of target-date funds available from which to choose. Some 401(k) plan administrators allow an individual to adjust the mix within the fund or purchase more appropriate funds responsive to their evolving needs, should they choose to do so at a later date.

Individuals also could augment their existing TDF by including diverse index funds that are more closely tailored to their individual needs at any given point in time.

An additional risk stems from a misconception and that is that a TDF “derisks” upon retirement. The fund attempts to provide for changing investment needs as the investor nears retirement; it does not eliminate risk.

Target-date funds reallocate the asset distribution on an annual basis to maintain the desired stock-to-bond ratio, relieving investors of an important chore many might otherwise neglect.

The idea is to simplify investing. But that doesn’t mean risk is gone.

Changing market conditions

A predetermined investment strategy also may at some point in the future no longer be appropriate or suitable due to a changing investment climate.

For the past decade, interest rates have been historically low and bond yields during this period negligible. Those TDFs whose weighting in bonds increased as the target date drew near would not have provided as generous a return had the reallocation been more heavily weighted towards stocks.

Additionally, in an historical aberration, stocks and bonds have moved in tandem recently, which diminishes the benefits of diversification.

If the goal is a retirement investment plan more responsive to changing needs, there is no substitute for vigilance. Investors should take an active role in managing their retirement savings plan and monitor the performance of their TDFs closely.

As there are hundreds of TDFs available, those planning for retirement should compare fees and each distinct product’s performance risk profile.