I listened to a money manager podcast this past week and he brought up an interesting observation having to do with the “velocity of money” and the lack thereof.

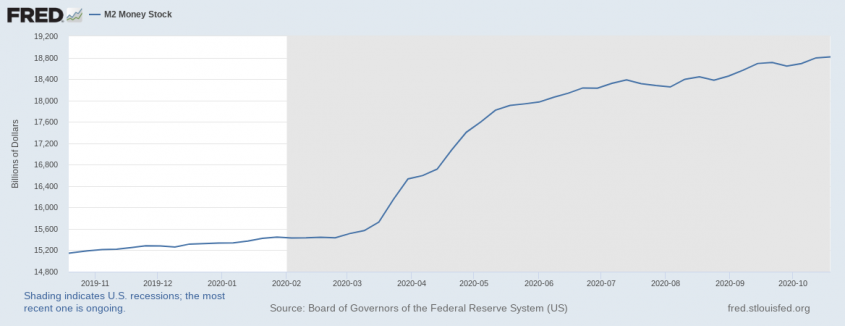

There are several measures of money supply, but one popular one is M2. M2 consists of cash, checking deposits, savings deposits, money market securities, money market funds assets, and other time deposits.

The “velocity” of M2 is a measurement of the rate at which M2 money is being turned over in the economy.

Here is an example of money turnover: Consider an economy consisting of two individuals, A and B, who have $100 each.

- A buys a car from B for $100.

- Then B purchases a home from A for $100.

- B has kids and enlists A’s help in adding new construction to his home. For his efforts, B pays A $100.

- A also sells a car he owns to B for $100.

Thus, both parties in the economy have made transactions worth $400, even though they only possessed $100 each.

In this economy, the velocity of money would be 2.0X, resulting from the $400 in transactions divided by the $200 in money supply. This multiplication in the value of goods and services exchanged is made possible through the velocity of money in an economy.

M2 velocity has been tracked since the late-1950s. See the chart below.

The velocity of M2 largely remained stable from the late-1950s until the early 1990s, when it rose to 2.2X in 1997.

It fell to 2.0X around 2006, and has since come down very sharply to around 1.1X now.

Despite incredible monetary stimulus from the Federal Reserve over the past several months, that stimulus has had a negligible effect on actually increasing the frequency in which the money is being used within the economy.

This is not what most people would intuitively expect. Furthermore, many economists would say that, until this money turnover materially increases, it is hard to argue for higher inflation and hence higher nominal interest rates.

What’s next?

I attribute some of this sharp downturn in M2 velocity to the changing mode of consumer good transactions, i.e., the advent of e-commerce and digitization of the retail world.

Also, the higher consumer savings rate since around 2006 has most likely had a pronounced effect on reducing monetary velocity.

I think this specific macroeconomic variable, which really does not get much attention from the financial media, should be continued to be watched by investors.

It can have a telling effect on the financial markets, both if it continues this 20-year trend — or if it starts to make a meaningful reversal.