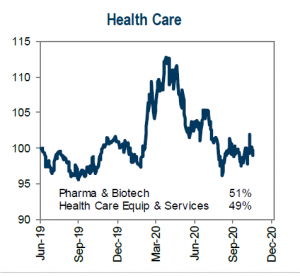

One equity sector I wanted to do a brief focus on this week is the healthcare sector. The chart below shows the sector’s performance relative to the S&P 500 since mid-2019.

Data points above 100 indicate positive relative outperformance. As seen, in the early stages of the pandemic the group showed solid positive alpha. Since August of this year, the sector has been nearly inline with the broad index, but with a slight upward trending bias.

Now refer to the valuation chart below. Shown here is the price/earnings multiple based on FY2 (roughly calendar year 2021) earnings per share of the healthcare sector relative to the overall market price/earnings (P/E) ratio using the S&P 500.

The chart goes back 30 years, with a couple reference points shown:

(1) the Clinton health plan and

(2) Obamacare.

Given the fairly lengthy look back, I believe it gives a good broad historical view of the valuation of this sector relative to the broad equity universe.

The median value over this time span is a relative multiple of 1.07X, so the sector’s P/E has historically had a 7% premium to the overall S&P 500 P/E.

As seen, currently the healthcare P/E is at a very large 23% discount to the market P/E, easily at a 30-year low. In fact, though not shown here, if one looks at the data, it would be found that the sector’s P/E is actually at or near an astounding 40-year low on this relative P/E measure.

Valuation anomaly

Heightened policy uncertainty by investors — as all as concern that healthcare policy will be a major legislative focus after the incoming Biden administration takes office — I believe have truly created a meaningful valuation anomaly for this sector.

If history is any guide these large outlier valuation relationships typically get reverted back to the mean over time. If so, investors could do quite well by being invested in the healthcare space over the coming months and quarters.

Two excellent choices to invest in the overall healthcare sector via a passive ETF are the Vanguard Health Care Index Fund ETF (VHT) or iShares U.S. Healthcare ETF (IYH).