Regular readers of my past articles are probably aware that I have been a fairly consistent endorser of value equity investing, certainly since mid-2020. I came across a few charts in a recent report that I thought adds some more ammunition for the value equity bulls.

The chart below shows the valuation of value equities relative to the broad equity universe going back to 1971. Taking this 49-year time frame and breaking it into percentiles (100th percentile being the most expensive, 1st percentile being the cheapest) we are currently at a very low 4th percentile rank.

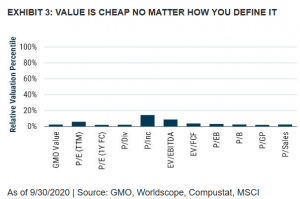

One may wonder if value equity is cheap across the spectrum of metrics or only in certain measures. The chart below from this same report addresses this fairly succinctly, I believe.

Eleven different valuation measures are shown, using earnings, cash flow, book value, enterprise value, sales, etc. Regardless of what measure you look at, we are currently at a very low percentile rank, indicating the cheapness of value equities presently.

In fact, the authors go on to state that for all but the P/Inc metric, each of these valuation metrics are as cheap as they have been for approximately 90% of the months going back to 1971.

The above analysis just gives a bit more credence for those in the investment community that are arguing that value stocks are incredibly cheap right now.

Additionally, there appears to finally be an identifiable shift in equity leadership reflecting an attempt by investors to proactively take advantage of this cheapness. An identifiable shift from growth equity to value equity has occurred starting back to early-September of this year, as shown in the chart below.

![]()

The chart shows the ratio of the S&P Growth Index to the S&P Value Index. The red line shows value outperforming growth, and the green line shows growth outperforming value.

As seen, while there has been a shift back and forth between the two styles, value has seemed to have been at the forefront since around September 1.

After several years of growth equity outperforming value equity, the long awaited shift may indeed be before us.

However, as is always true in the world of investing, only time will tell.