While people transact in dollars, the wealthy and governments transact in gold.

The United States is No. 1 in this regard. The U.S. government has more than 8,133 tons of gold in its reserves.

In fact, the United States has more gold stored in its reserves than Germany and Italy combined, which are respectively number two and three.

Russia is number five on this list and has over 2,150 tons of gold in its reserves. The country has quadrupled its gold reserves in the last 10 years, perhaps in a bid to lessen its dependence on the American dollar.

China comes in at number six with over 1,945 tons of gold. The country purchased 94 tons of gold in 2019 alone.

So, why do countries stockpile gold?

The severity of any potential currency war could be ascertained by analyzing gold prices and which countries are buying. “The growing threat of a currency war in recent days could add to this momentum and prove an overall tailwind for gold,” said finance expert Alain Bokobza.

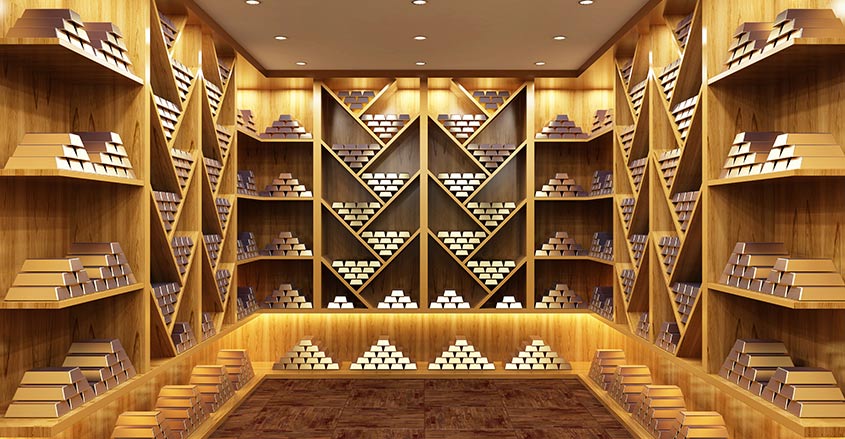

Gold hoarding?

One ounce of gold currently has a value of about $1,495. Governments, federal reserve executives, and central banks watch gold prices closely because gold is the coin of governments.

Healthy gold reserves project economic national health and act as a credit buffer for fiat currencies. Gold can also be leveraged in international trade and investments with decreased worry of volatility.

It can also be used in international economic dealings. Some economic experts, as well as President Donald Trump, think other countries are hoarding gold while selling U.S. debt securities to negatively manipulate the American dollar.

Until 1933, the U.S. dollar was tethered to gold and derived its value from it. Americans could trade dollars for their equivalent in gold.

President Franklin D. Roosevelt severed gold’s tethering to the dollar after the Great Depression for many reasons. Mainly, Americans could have appreciably depleted gold supplies via bank withdrawal runs.

Foreigners and foreign governments could swap dollars for gold until 1971, when President Richard Nixon officially terminated the so-called “gold standard.”

American dollars derive value as a fiat currency, or the idea that trust in governments and central banks imbue currency with value.