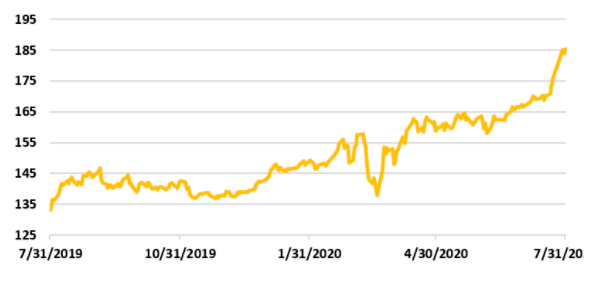

Investor interest in gold has been high during the last few months, driven by the global healthcare crisis, low interest rates and U.S. equity markets lofty valuations.

Accordingly, gold prices have sharply increased in the last few weeks and now stand at historical highs.

A popular way of investing in gold is the SPDR Gold Trust (GLD) ETF. It foregoes physically holding the metal and has ample price transparency and liquidity.

Listed options in GLD trade in lots of 100 shares of the ETF. Expirations range from a few days to close to two years. With GLD trading at about $185, at the money call prices range from about $5 dollars for a 1-month expiration, up to $16 dollars for a 1-year expiration.

Buying GLD call options provides leverage and limits maximum losses to the amount of premium paid. The main drawback for call buyers is the cost of the option. If gold fails to appreciate, the strategy can cost investors their full premium.

The call spread strategy

Call spreads are an alternative strategy, providing directional exposure to GLD price increases at a reduced premium cost. They involve buying a call and simultaneously selling a higher strike call. Both options are for equal GLD units and have the same expiration date.

The maximum payout of a call spread is the difference between the strikes. Compared to vanilla calls the main drawback of call spreads is their limited upside potential.

The strategy is also motivated by relative high premiums for out of the money calls when compared to lower strikes. Gold is a haven in volatile times, and demand for out of the money calls is higher than for lower strike options. In technical terms, the cost of gold is skewed toward higher strikes.

Compare the three months premium of a call with its strike located $10 out of the money (195 strike) to that of a put struck $10 out of the money (175 strike).

Both strikes are at similar distances ($10) to the current GLD $185 price, but the 195 strike call costs $4.17, and the 175 put costs $2.90. This bias carries across expirations.

Call spread examples

The maximum payout of a call spread is the difference between the two options strikes. Buying a $185 (at the money) call and selling a $195 (out of the money) call has a maximum combined payout at expiration of $10, which is the payout when GLD expires above 195.

At the money to out of the money call spreads — GLD = $185

| Tenor | Expiration | 185 Strike Call (Premium Paid) | 195 Strike Call (Premium Received) | Net Spread (Premium Paid) |

| 1 Month | 9/4/2020 | -$5.15 | +$2.00 | -$3.14 |

| 3 Month | 10/16/2020 | -$7.40 | +$4.17 | -$3.23 |

| 6 Month | 1/15/2021 | -$11.00 | +$7.70 | -$3.30 |

| 12 Month | 7/16/2021 | -$16.15 | +$12.75 | -$3.40 |

When held to expiration, there are three relevant scenarios for the payout:

- If GLD expires at or above the high strike (195), the call spread payout is $10.

- If GLD is below the low strike (185), the call spread payout is zero.

- If GLD expires above 185, and below 195, the payout is the difference between the price at expiration and 195.

Compared to a 1-year call, per dollar of premium spent, the strategy provides a higher return at expiration GLD prices below 232.5.

Out of the money strikes — GLD call spreads

| Tenor | Expiration | 200 Strike Call (Premium Paid) | 210 Strike Call (Premium Received) | Net Spread (Premium Paid) |

| 1 Month | 9/4/2020 | -$1.30 | +$0.57 | -$0.73 |

| 3 Month | 10/16/2020 | -$3.20 | +$1.92 | -$1.28 |

| 6 Month | 1/15/2021 | -$6.55 | +4.80 | -$1.75 |

| 12 Month | 7/16/2021 | -$11.40 | +$9.15 | -$2.25 |

Above are higher strike call spreads with lower net premiums. The likelihood of the strategies producing a positive payout is reduced because the strike is further away from the current GLD market price.

Note the leverage of up to five times in payouts above the high strike.

How much GLD is expected to move and over what period of time, and the capital allocated to the strategy, are key considerations in choosing the expiration date of the strategy and strike location.