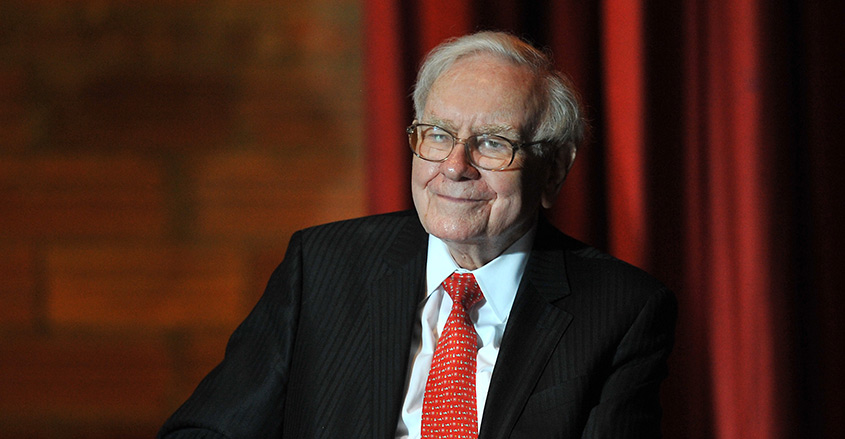

Warren Buffett has put an end to the market speculation that Berkshire Hathaway was in talks to buy the beleaguered California utility company PG&E.

Speaking to CNBC, Buffett made it clear that there was no truth to this story, and that obviously he “would know” if his company was planning to acquire PG&E.

The rumor had quickly gathered steam when an online report claimed that a deal was on. The stock price of PG&E zoomed more than 25% following the story.

California’s biggest investor-owned utility is facing potential liability of up to $30 billion from wildfires that occurred in 2017 and 2018.

The company’s stock took a hit when news began to emerge that one of the deadlines fires in the history of the state, one resulting in the deaths of 86 people, was “probably” caused by PG&E equipment.

The stock sank further in January this year when the company declared that it would file Chapter 11 bankruptcy. However, some of the prominent hedge funds on Wall Street, including Baupost Group, D.E. Shaw and Appaloosa Management continued to hold stakes in the utility after the wildfire.

Although each hedge fund is likely to have its own reasons for sticking to their position in the company, analysts have come up with theories on why the funds have stakes in the embattled utility.

Seth Klarman buys in

Seth Klarman’s Baupost Group first bought into PG&E in the first quarter of 2018. By the fourth quarter, nearly all major institutional investors had raised their holdings in the company.

As the Camp Fire struck, PG&E stock dropped almost 50% in the last quarter. Notable buyers in Q4 included Vanguard Group (9.6 million shares) and Anchorage Capital (9.5 million shares).

Seth Klarman had bought 14.5 million PG&E shares in the third quarter, before the fires, and sold 18% of his holdings in final quarter.

Clearly, the value of his investment in the company is likely to have declined.

But there’s a catch. Baupost also had purchased insurance amounting to $1 billion against their PG&E bet.

This move gives Baupost the right to recover its losses from the 2017 wildfires.

The insurance claims could become a hedge against the losses sustained by holding PG&E’s shares. Under the bankruptcy proceedings, the fund could become eligible for repayment.