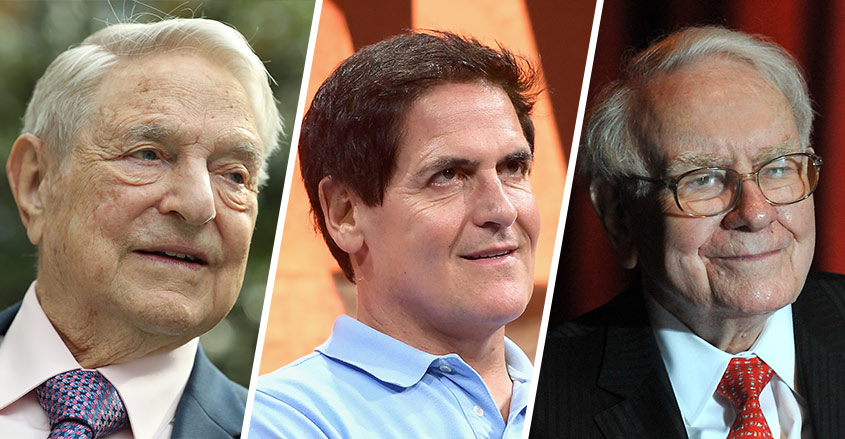

Billionaires George Soros, Warren Buffett, and Mark Cuban did not become rich accidentally.

They made consistently smart investment decisions, which helped them create great personal wealth as well as economic value for society.

While there is no guarantee that what worked for them would also work for you, here are a few vital tips from these people with demonstrated wisdom and experience about how best to invest your money.

Do not be swayed by others

George Soros expounds on his “theory of reflexivity” in his book, The Crisis of Global Capitalism.

According to Soros, most investors do not base their decisions on market reality but their perceptions of reality. The actions that arise out of these perceptions disrupt market equilibrium and cause prices to become increasingly removed from reality.

While his theory contradicts the mainstream economic theory, which says that economic participants are largely rational in their decisions, Soros strongly advises investors to resist getting swayed by public perceptions of the market and try to stick to the fundamentals of reality.

Pay off your debts

The self-made billionaire Mark Cuban recommends that the best investment any individual can make is paying off whatever debts they may have.

According to Cuban, the money that you will save in terms of interest by not having a debt will prove to be better that any returns you could potentially achieve by investing that money.

Whether it is credit card debt or a student loan with an high interest rate, if you pay off that expensive loan you are effectively making a return equal to the loan rate.

That is your immediate return, and it has zero risk.

Invest in businesses you understand

Investing legend Warren Buffett says that if you are putting your money in the stock markets, never invest in businesses that you cannot understand.

Instead, stay within your “circle of competence” and invest in companies and sectors with which you are familiar.

At the end of the day, risk originates from not knowing what you are doing, Buffet says.

Invest in people

The flamboyant British billionaire entrepreneur Richard Branson suggests investing in relationships.

The key to business success is all about “people, people, people,” says Branson. If you care for your people, the rewards to your bottom line will automatically follow.

Branson says that the most important skills he had to learn on his way to success were people skills. To develop effective interpersonal skills, Branson suggests that you pay attention and be a great listener.

Invest in a home

Personal finance expert and self-made millionaire David Bach says that the simple escalator to wealth is buying your own home.

According to Bach, if Millennials fail to buy a home, statistically their chances of achieving wealth in America are negligible. To this day, the average homeowner is 38 times richer than a renter, Bach says.

Five simple steps that you can put into practice today to become wealthier every day going forward.

What are your best wealth building ideas? Let us know in the comments!