Ever wonder how much you are due from the government once you hit retirement age? Wonder no more.

It’s all in your Social Security Statement. The statement shows how much you have paid into Social Security and Medicare taxes over your whole career.

In addition, it explains how much you would get in Social Security benefits when you reach full retirement age.

In addition, if you become disabled and unable to work, you may be eligible for disability benefits. That’s explained in your statement.

If the family members who depend on you outlive you, they may be eligible for survivor benefits. That’s in there, too.

How much you get in benefits depends on your earnings.

Social Security benefits are not meant to be your sole source of income after retirement. It is estimated that Social Security should only replace about 40 percent of your annual pre-retirement income.

You will need other savings, investments, pensions, or retirement accounts to live comfortably.

Social Security payments go up

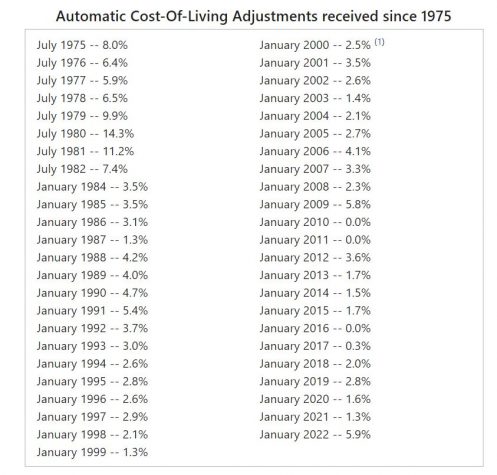

As inflation rises, so do Social Security payments.

As measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers, Social Security payments are adjusted every year to keep pace with inflation. For example, the cost-of-living adjustment for Social Security in 2022 is 5.9%, significantly higher than the 1.3% adjustment for 2021.

Information about Medicare changes, when announced, will be available at www.medicare.gov.

For Social Security beneficiaries receiving Medicare, Social Security will not be able to compute their new benefit amount until after Medicare premium amounts are announced.

To see your Statement online anytime, create a “My Social Security” at the Social Security Administration website.