If you were to tell someone that you were putting any extra cash you had into the market instead of paying off debt, they might think you have lost your mind.

Especially if they follow the personal finance guru Dave Ramsey.

However, I am a strong believer that not all debt is bad debt. For me, there are two kinds of debt: debt that earns interest and debt that is interest-free.

I currently have both kinds of debt, which I am sure many others do as well. So when I suggest using any extra cash to put into the market instead of paying off debt, I am referring to the interest-free kind.

Also, it is important to note that you should continue monthly payments for all debt regardless of which kind.

However, personally I prefer to use my extra cash to play the market or build up my cash on hand — instead of making paying down debt by making extra payments.

The reason this works for me right now is that the stock market is in a very unique situation, the COVID-19 pandemic.

In part because of the pandemic, not only have I managed to get several wonderful companies at great on sale prices but I am also building up cash on hand with extra cash I have and doing options trading.

That way, when another downturn happens I can jump on some more companies at discounted prices and make my portfolio even stronger.

The long game

When I look at investors and what their main goals are, they fall into one of two categories.

Category one is the investor that tries to take advantage of quick gains so they can increase their profits drastically over a short period of time.

To me, this is very risky and can get you burned quicker than you can recover. I believe that is what has got a lot of Robinhood investors, the younger investors who are using apps to buy slices of stock, in trouble this year.

Category two, where I fall, is the long-term investor.

This is the type of investor who is playing the long game and basing their trades and positions on long-term gains. This means getting great companies with strong balance sheets at great prices and holding them long-term.

Then, once you think the company has reached or is near the top in terms of share price, you sell high and take in your huge profit, thus giving you more money to invest.

My main goal is to make sure that I am setting myself up for financial freedom much sooner than retirement, as well as making sure my retirement isn’t spent penny-pinching my way to the grave.

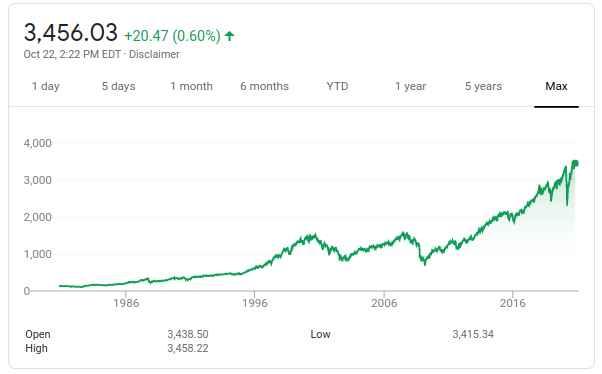

And right now, I believe that the market has been and will be one of the greatest investing opportunities of this generation for the months and years to come.

So, by building up your cash in order to buy the companies you want at discounted prices, you will be playing a much less risky game while also being able to make sure your future is much better financially.

You can even get yourself to the point that you can pay off all your debt at once or in a much shorter period of time because you are taking this amazing opportunity that the market is presenting to all of us.