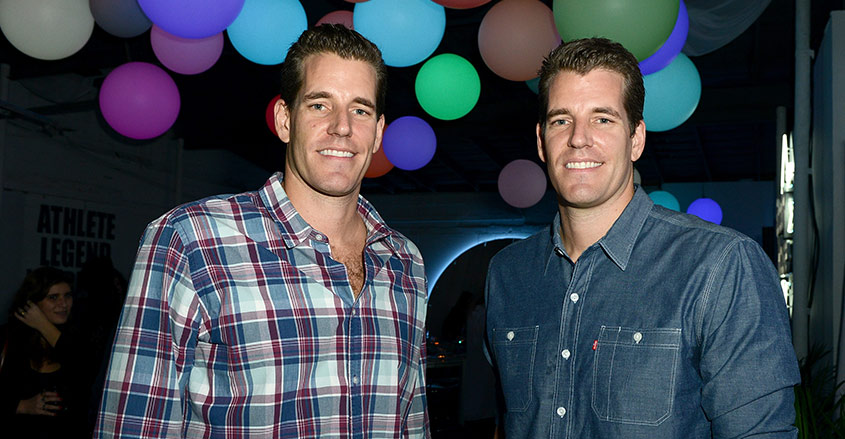

Cameron and Tyler Winklevoss, the founders of cryptocurrency exchange Gemini, want to see U.S. cryptocurrency trading platforms form a self-regulatory organization (SRO).

The announcement from the brothers, best known for suing Facebook founder Mark Zuckerberg for copying their early version of the social network at Harvard and winning $65 million in court, came through a blog post.

Now venture capitalists, the brothers were early investors in cryptocurrency and reportedly hold $1 billion in Bitcoin.

Regulators worldwide have been cracking down on crypto trading sites, while Google recently decided to ban all ads for crypto-related ventures on its network, starting in June.

“We believe a thoughtful SRO framework that provides a virtual commodity regulatory program for the virtual commodity industry is the next logical step in the maturation of this market.

“We look forward to engaging with industry leaders, participants, regulators, and legislators on this proposal.”

The proposed Virtual Commodity Association (VCA) would be accessible to all crypto-asset trading sites that serve U.S. customers.

Members would have to comply, in writing, that they will agree to certain rules governing security, fiscal management, and information sharing.

Members would not be permitted to list security tokens unless they have acquired a securities trading license beforehand.

The organization would seek to meet the following goals:

“Foster financially sound, responsible, and innovative virtual commodity markets through a system of industry sponsored standards, sound practices, and oversight that promotes price discovery, efficiency, and transparency.”

“Incentivize the detection and deterrence of manipulative and fraudulent acts and practices, including partnering with regulators and particularly the CFTC to share or refer information, as appropriate.”

“Require member firms to commit in writing, upon joining VCA, to operating their virtual commodity markets in compliance with Sound Practices, described below; and provide a sanctions based accountability program to compel ongoing member compliance.”

The “Sounds Practices,” as the blog post describes them, are as follows:

“Responsible Financial Management – Establish a transparent program of financial responsibility and controls for members to ensure confidence in the fiscal soundness of members and to encourage customer confidence.”

“Transparency; Conflicts of Interest – Provide appropriate transparency regarding bids, offers, executions, and other relevant data to the public; adopt policies to avoid conflicts of interest.”

“Rules Based Markets – Maintain and enforce a system of marketplace conduct rules; and implement policies and procedures to respond to and address customer concerns and complaints.”

“Cyber and Information Security; Recordkeeping – Implement and maintain current best practices with respect to cybersecurity, information security, and recordkeeping.”

“Surveillance – Monitor and surveil markets to detect and deter (and where appropriate, discipline) manipulative and fraudulent acts and practices.”

“Information Sharing – Agree to enter into information sharing agreements for the purposes of marketplace surveillance with other members and with regulated exchanges and trading platforms that list products based on virtual commodities.”

“Cooperation With Regulators – Among other things, agree to report instances of manipulative and fraudulent conduct to the CFTC and other regulators as appropriate.”

“Legal Analysis – Agree to perform proper diligence and legal analysis when determining the legal status of a virtual commodity for listing and trading in order to avoid listing and trading security tokens, unless the member has obtained necessary licenses for security tokens.”

In recent months, the Winklevoss Twins has become some of cryptocurrencies loudest voices when it comes to regulation.

Their own cryptocurrency exchange, Gemini, is one of the few exchanges that has been granted a BitLicense under New York’s cryptocurrency regulatory guidelines.