Government payouts and loose monetary policy are both contributing to a weak dollar. When this situation occurs, people look to safeguard their money. The uncertainty leads citizens to be concerned about future buying power.

Gold has seen quite a run-up in its price, lately. Given its status as the de facto standard for safe haven investments, this makes sense. However, the price is leaving investors wondering if it’s advanced too far, too quickly.

A good alternative could be silver.

Silver can serve as a value store. It has a history that parallels gold for its use in this hedging capacity.

And silver is the clear winner in its industrial use when compared to gold. Both metals are used for making jewelry. Silver stands out in its ability to conduct electricity. This makes it a crucial element for electronics manufacturers.

Silver investing did lose some of its luster with the decline of photography paper. The demand for this product has all but evaporated in the digital age.

With the growing sentiment for environmentally friendly products and technologies, solar energy companies are increasing their use of silver. The effort to save the planet is not likely to disappear anytime soon.

Common risks

The strong industrial use of silver makes it more dependent on economic factors.

It could be argued that a reduction in mining leads to shortages once excess inventory dries up. This eventually causes prices to rise. For current holders of silver for hedging purposes, this is a positive development.

However, the slowdown in production can cause short-term pain for companies, employees of those companies, and consumers.

This dynamic can happen with gold, too. But the impact is likely to be less due to lower industrial demand for gold.

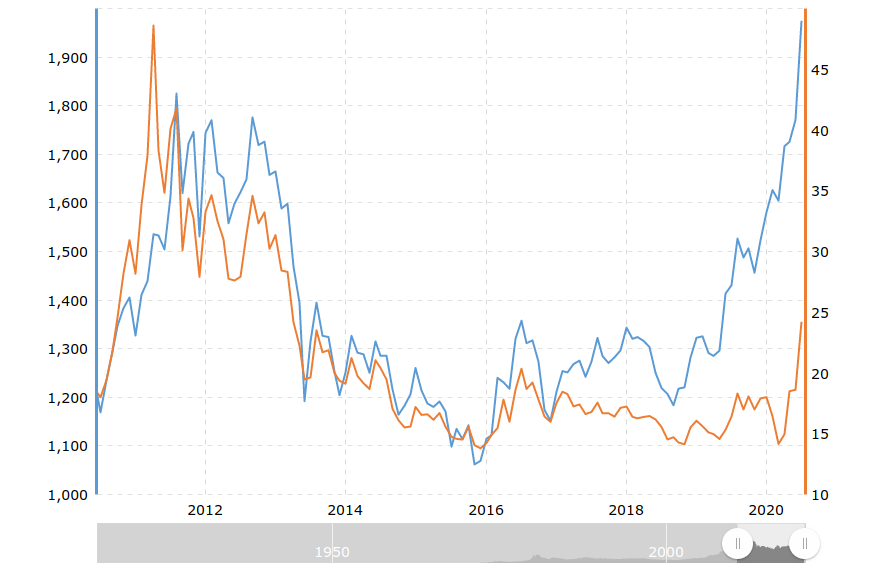

Silver is more volatile than gold. A comparison of the standard deviations of a silver ETF (SLV) with a gold ETF (GLD) shows silver’s volatility is almost double that of gold’s volatility.

ETFs can be used for the standard deviation calculation as it is easier to obtain historical pricing. However, ETF instruments are usually proxies for the commodities they track. This constraint should be taken into consideration when evaluating gold and silver for investment purposes.

For some investors, higher volatility is positive. It can give these investors more opportunities to profit from the variability of price moves.

Volatility is what moves the price of options, too. However, as a value store, this volatility may not be a welcome feature.

If investors believe that gold prices are too frothy, they can add silver to their portfolios as an alternative. Adding a combination of the two may offer some diversification in portfolios. Having silver as an option provides flexibility with the construction of these portfolios.

The process of buying silver is similar to gold. It comes in a variety of forms. If you buy physical silver from a dealer, you’ll need to consider storage and insurance.

Finding a reputable dealer is challenging for the average investor. Unless people are involved with the silver market, they aren’t likely to keep track of its developments.

Investors have the option of buying ETFs instead. In the silver market, the most popular choices are SLV and SIVR. Of the two, SIVR has a lower expense ratio. However, SLV is more liquid. Both are optionable.

Some mutual funds offer a variety of precious metals which can provide a further layer of protection through diversification.

Like all investments, investors should investigate the risk associated with each choice.