Whether you’re retiring in 10 years, 5 years, 3 years, 1 year, or have just retired, getting organized, planning ahead, and being in control of your money-related matters, goes a long way toward making your retirement experience a little less stressful.

Furthermore, everyone’s retirement is unique. Beyond deciding when to begin receiving retirement benefits, other factors that can affect your benefits include whether you continue to work, what type of job you had, and if you have a pension from certain jobs.

The number one thing everyone must do is learn how to save, save, and save money because we do not know what our true-life expectancy is going to be. Including unexpected non-routine expenses in retirement such as a large medical expense or major home repair. Will you have to help support a family member?

So if you don’t currently have a retirement checklist in place, here are eight points should help guide you in the right direction!

Choose your retirement age

Full retirement age is the age when you can start receiving your full retirement benefit amount. The full retirement age is 66 if you were born from 1943 to 1954.

The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born in 1960 or later, full retirement benefits are payable at age 67. You can get Social Security retirement benefits as early as age 62.

However, the U.S. government will reduce your benefit if you start receiving benefits before your full retirement age. When you delay benefits beyond your full retirement age, the amount of your retirement benefit will continue to increase up until age 70.

What will you do in your retirement?

While it’s nice to dream big, be realistic about your expected monthly expenses. Are you going to travel, live like you are on an extended vacation, work part-time, or live in an assisted living facility? All of these things matter because you need to budget for your needs, wants, and wishes.

Where will you live?

Are you going to downsize your current home if the kids are out on their own? Are you going to relocate to a state that doesn’t have state income taxes?

Currently, nine states don’t have a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Do you know what the cost of living is going to be compared to where you are? If not, check out a cost of living calculator by location.

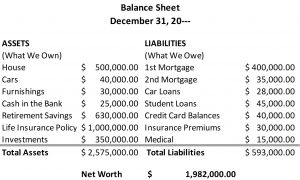

Do you know net worth?

How much cash, investments, home, furnishings, car, life insurance, etc.? How much debt have you accumulated? Debt can be overwhelming, but if you separate the “good” debt (like a mortgage) from the “bad” debt (like credit cards) this may help alleviate some of the stress.

The bottom line is you need to pay off the bad debt first and have a positive net worth. Without serious savings, you might have to work longer or part-time or considering changing your lifestyle to accommodate your finances.

How is your health?

Have you and your spouse considered medical expenses and insurance costs in older age? Are you planning on using Medicare?

Unfortunately, with age comes increased medical risk and expense, so it’s important to plan ahead and account for a big expense down the road.

Have you taken steps to focus on planning?

Do you have children, grandchildren, and siblings? Have you made your wishes known with a will, living will, trust and medical directives?

Do you have an accountant or a financial professional to help with your taxes?

Have you considered three traditional retirement withdrawal strategies? These are the 4% rule, the strategic withdrawal plan, and the bucket strategy.

If not, you should meet with a financial professional to discuss the tax impact on your income sources ahead of time. The more tax-diversified your sources of income, the further you’ll be able to keep and stretch your retirement funds.

Lastly, review your plan regularly

It isn’t a concrete plan set in stone. Being tactical and rebalancing your investments annually to be in alignment with your goals is important. The market moves up and down based upon economic and market volatility and it’s important to make sure your investment portfolios are still aligned to your current and long-term goals that you established.