Sending a child to college is an expensive proposition. Sending a second child to college while still paying for the first child’s tuition and fees and room and board is just piling on.

In the time of Covid-19, quarantines and remote learning, paying to “send’’ a child to college when they actually don’t go anywhere seems foolish. Much of the appeal of going away to college is the “going away” part, the social growth that occurs by being on your own.

But it seems absurd to set a child up in a dorm room or apartment at campus only to have them sit in those living quarters taking classes remotely.

Is college even worth the expense anymore?

All of your child’s friends likely are “going” to college, one way or another. For many communities in the United States it is given for a high school student to extend his or her academic career in either a four-year public or private institution.

Still is it necessary to pay for four years of college tuition in order to give your child the best chance to succeed in the world? Or are there ways to spend less money and still aim your child toward professional success down the line?

More choices

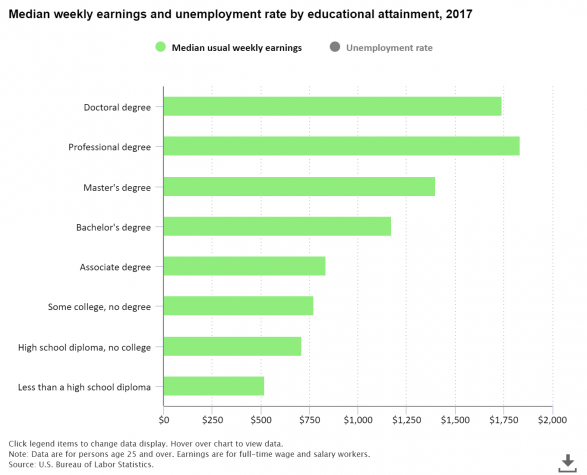

Properly applied, a college education can lead to a successful occupational life. Statistics show that a person with a bachelor’s degree will earn 66% more than those without over a lifetime.

Looking the other direction, unemployment among people who ended their academic career at high school averages 8% higher compared to people who earned a college degree.

But there are numerous examples of successful people in the United States who did not attend or complete college. You don’t have point to the insane examples, such as Bill Gates or Steve Jobs. You probably know someone who is a successful businessman or technician who did not acquire a college degree.

The fact is that if you go to the trouble of paying for your child’s college education and put yourself or your child into significant debt to do so, you expect results. Those expectations can put an undue pressure on the child and can strain relationships.

You certainly are willing to pay for your child’s college education. You likely put away funds for just that reason. But it behooves you to discuss with your child their reason for wanting to go to college, their educational and occupational goals, to determine if a four-year school away from home is the proper move.

There is a way to meet the college demands of your child halfway, eliminating much of the expense of the four-year experience. Community colleges, for instance, are becoming popular among Generation Z students and their parents.

Local college options allow a student two years to complete general studies classes that can transfer to almost any four-year school while living at home or in a nearby apartment. The student likely can pursue part-time work while determining for sure that they want to extend their academic pursuits to get that bachelor’s degree.

After the Great Recession, for instance, community college enrollment rose significantly. President Barack Obama’s pitch for community college education during his presidency went a long way to legitimizing the idea of using community college as a stepping stone to a four-year school and reducing the cost of that eventual degree by thousands of dollars.

A different path

There is another way, and four simple words describe it. Those words are: The world needs plumbers.

There are many 18-year-olds who feel they are done with book learning and want to apply their skills and minds to a trade immediately after high school. Highly rated, accredited technical schools are well-equipped to find apprenticeships and jobs for students as well as graduates, and your child can be making real money in two or three years rather than hoping that a more expensive four-year college degree is going to lead somewhere.

Technical schools today do not necessarily limit themselves to automobile maintenance or HVAC work. There are schools which train students in digital fields such as software coding, and there is no indication we are going to stop using the Internet any time soon.

With so much money involved in advancing your child’s life beyond high school, a meaningful conversation with your child about his or her hopes and dreams as well as their realistic goals could end up saving you both a great deal of money and make for a happier transition to adulthood.