In this article I make a brief comparison of growth stocks versus value stocks, a topic often addressed by the mainstream financial media.

Growth stocks typically offer a substantially higher growth rate as compared to the mean growth rate prevailing in the overall market.

These stocks usually are priced higher in the market on several measures such as: price/earnings, price/cash flow, price/sales, enterprise value/cash flow, etc.

In theory, growth stocks are less sensitive to the overall economic conditions given their higher embedded growth rate at the company level

In comparison, value stocks trade at a lower multiple on several fundamental measures such as earnings, sales, cash flow, enterprise value, book value, etc.

These shares typically are more established firms with a long track record, but not always so. Value stocks are expected to experience multiple revaluations (increases) as the market recognizes their fundamentals over time.

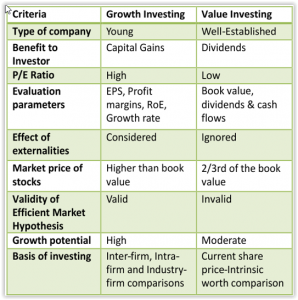

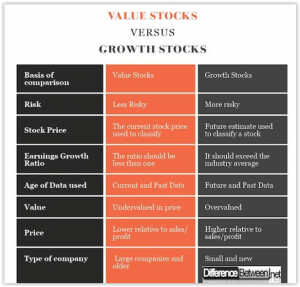

Side by side

A couple comparison charts are shown below. I don’t necessarily agree with each individual characteristic as shown, but I thought they generally do offer a good side-by-side compare.

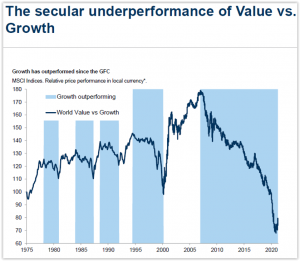

Lastly, here is a brief performance comparison of growth stocks versus value stocks over the past 45 years:

The out-performance of growth stocks versus value stocks since the Great Financial Crisis of 2007-2008 is quite striking.

Much of this is due to the steadily decline interest rates over this time period. More recently, specifically since the fourth quarter of 2020, as interest rates have started to move upward, value stocks have started to reverse this trend.

Value has fairly consistently outperformed growth stocks now for the past several months. The great debate in the financial news media these days revolves around whether the out-performance of value stocks will continue, or whether value stocks will succumb to growth stocks once again and keep the trend over the past 13 to 14 years going.