Rebalancing your portfolio is an important risk management habit. It avoids oversized exposures and preserves diversification. As the saying goes “no one goes bankrupt from taking profits.”

Modern portfolio theory suggests that diversification reduces the volatility of a portfolio without reducing its expected return. This year, technology stocks have outpaced other sectors.

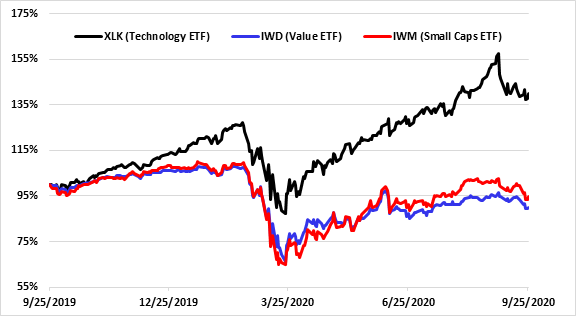

The chart compares the 12 months performance of three ETFs from different sectors: For small capitalization, iShares Russell 2000 ETF (IWM). For value stocks, iShares Russell 1000 Value ETF (IWD). And for technology, Technology Select Sector SPDR Fund (XLK)).

ETF Sector Performance – 12 months percentage price change. Data source: Yahoo Finance.

We know technology has outperformed small capitalization and value. This trend may persist, but there is no guarantee that technology companies will further outpace other sectors.

Accordingly, one portfolio rebalancing strategy would be to rotate into underperforming sectors.

The options strategy

Options can be used to rotate sectors, with a two-step strategy. The first step is to sell out of the money covered calls on individual technology stocks (assumed to be existing holdings).

The second step is to use the premium generated from the covered calls to buy at the money value or small capitalization ETFs.

The strategy can be executed in a premium neutral manner. Instead of just pocketing the covered call option premium, it is invested into a similar cost option to rotate away from existing positions.

The approach is more bullish than a simple covered call. When both sectors rally in tandem there is a degree of leverage, up to the out of the money covered call strike. The downside risk remains unchanged from existing positions as the covered calls are struck above current market levels.

Technology sector individual stocks volatility and option premiums are high. Individual stock prices in the sector tend to move faster when rising, “melting up” when growth prospects improve and there is higher demand for shares.

High strike options on the call side have high demand, as calls provide leveraged exposure to upward stock price movements. The above factors elevate high strike option premiums.

The ETFs used to rotate into new sectors have a different volatility profile. Indexes are less volatile than individual stocks. Individual stock price changes within an index partially cancel out, resulting in lower index than individual stock volatility.

ETFs underlying the call options have lower volatility than technology stocks. This allows for the strategy to be implemented at ETF strikes closer to current prices than those used in the covered calls, without having to pay a premium differential.

| Company | Ticker | 3-Month 10% Out of the Money Strikes |

| Apple Inc. | AAPL | 6% |

| Tesla, Inc. | TSLA | 15% |

| Amazon.com, Inc. | AMZN | 7% |

| iShares Russell 1000 Value ETF | IWD | 7% (at the money) |

| iShares Russell 2000 ETF | IWM | 5.75% (at the money) |

Call option premiums for three months expiration. Data source: Yahoo Finance.

The table presents percentage premium values for different technology stocks maturing in three months, with 10% out of the money strikes. The two bottom rows display ETF premiums for the same expiration, struck at the money (the current market price).

Premiums generated by selling out of the money covered calls are close to or exceed (substantially for Tesla) the premiums needed to purchase at the money ETF calls.

The target scenario is a cyclical bullish rally across sectors, materializing once elections and pandemic uncertainty clears up. It envisions outperformance of sectors that have lagged. Three months expirations are used to go over the election cycle.

In the target scenario, the strategy may benefit in two fronts. Technology upside up to the covered calls strike (10% above current prices). ETF call options in their sectors.

In a generalized sell off you still own technology stocks. If technology rallies but the ETFs do not, individual stocks appreciation is captured up to the covered call strike. The strategy makes profits in this scenario but underperforms for technology stocks that rally above 10%.

The options purchased are struck at the money, so ETF appreciation is fully captured. No downside price risk is introduced from the ETFs, other than the foregone premium.

Disclosure: I currently hold a long position in Amazon (AMZN) stock.