-

Preparing for retirement means budgeting and making important lifestyle decisions.

-

Your income is a crucial as your outgo, so healthcare is a big area to explore.

-

The gig economy offers many opportunities to earn income after regular work stops.

-

Get your adults kids on board so they understand what you’re doing financially and why.

Americans aren’t exactly renowned for planning. In fact, many people spend more time planning their next vacation than they do working up a life plan after retirement.

Yet retirement brings significant lifestyle changes and financial changes, both of which requires thorough planning for smooth sailing.

A few generations ago, retirement planning was simpler than it was today. Simply stop working, and draw on savings and pensions to live out those final restful years of retirement with family and friends.

Now the definition has widened. Longer life expectancy means people are choosing to do different things with retirement.

So if you would like to plan your perfect retirement? Where do you begin?

Here are some of the things you might want to consider for your plan after retirement:

Spouse and family

The ideal plan after retirement doesn’t just involve you, but your household and family. This makes planning for your spouse and loved ones a priority.

According to the Administration for Community Living, females reaching age 65 have an average life expectancy of 20.6 more years, while males only have an average life expectancy of 18 years — a difference that might be worth considering.

As we get older, the need for care increases. According to the Administration for Community Living, in 2017 the percentage of older adults age 85 and over needing help with personal care was 22%, which is more than double the 9% level for adults aged 75 to 84.

Although Medicare Part A covers some level of hospitalization (assuming you have worked in the U.S. long enough to qualify) most of Medicare coverage is not free, and you will also have significant out-of-pocket costs, which most people tend to under-estimate.

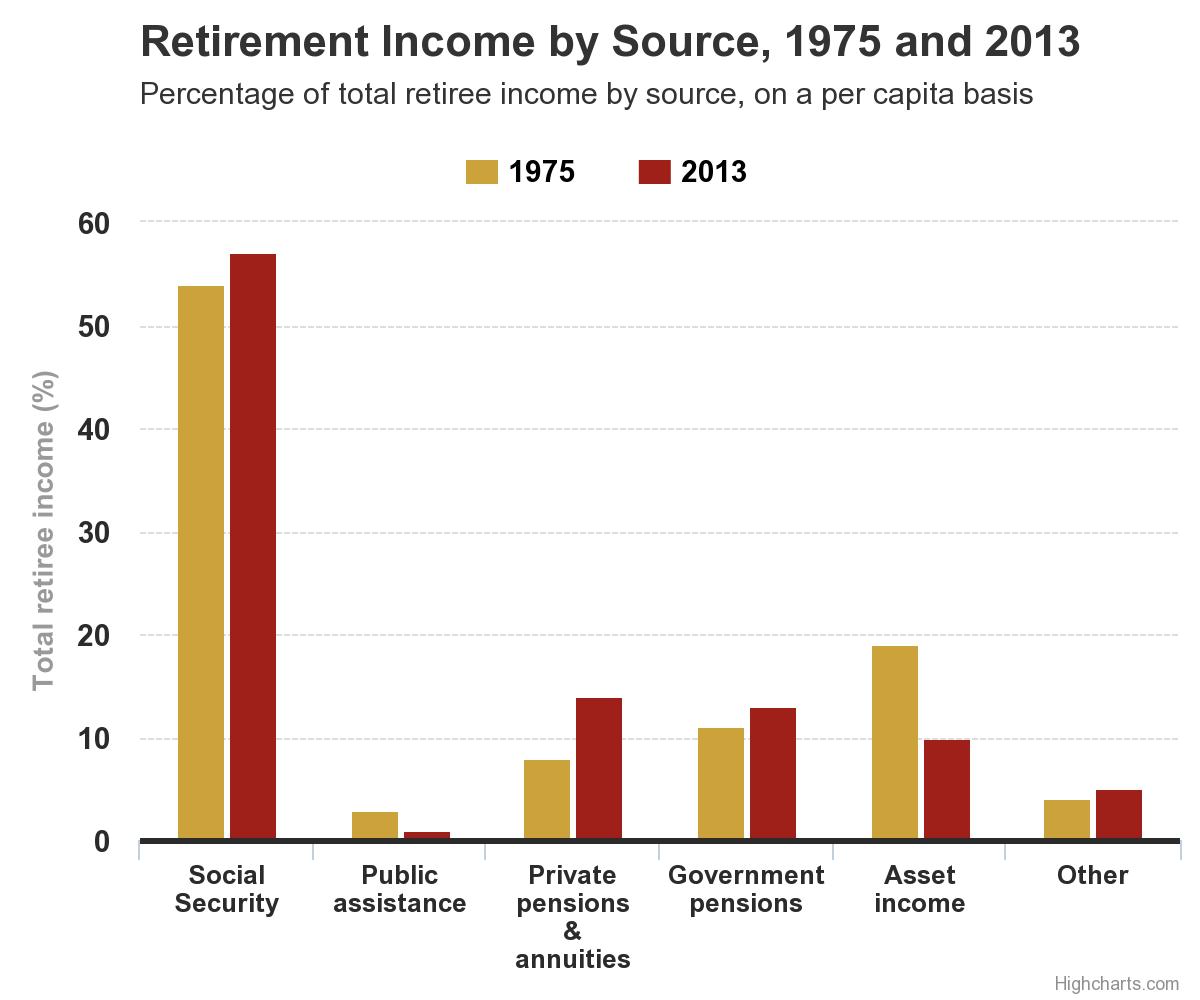

Income plan

Don’t let your paycheck retire before you do, and make sure you have the appropriate investment choices in place to support your retirement income goals.

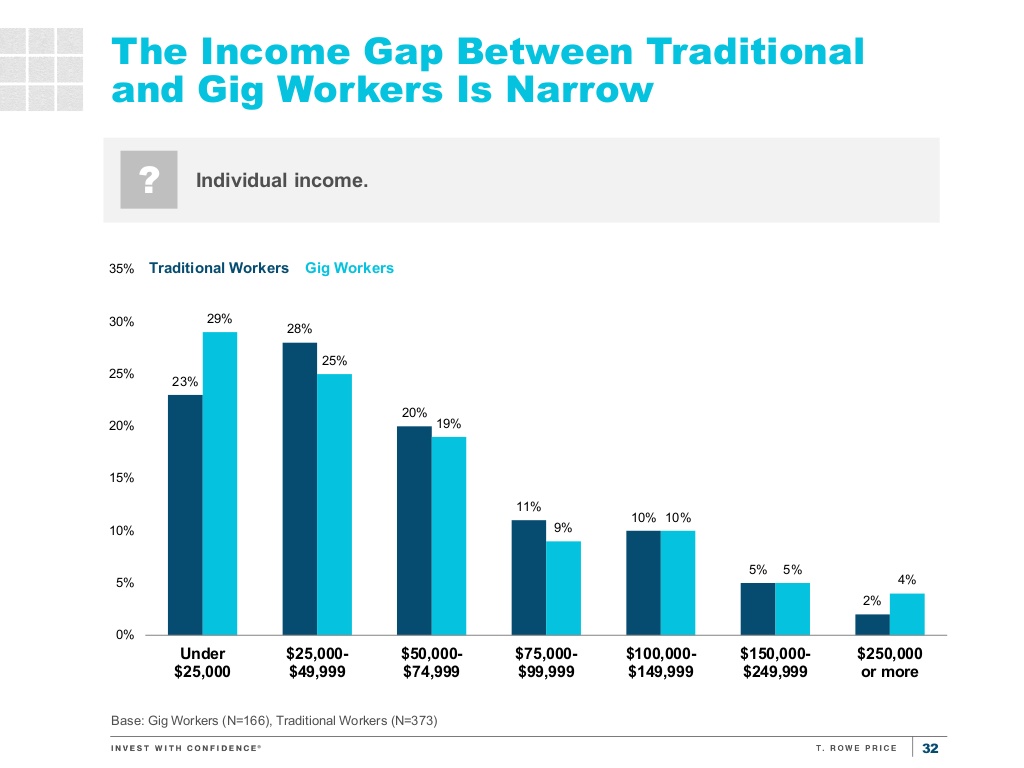

If you plan to keep working part-time as part of your plan after retirement, as many American workers do, the gig economy provides increasing opportunities to do so, but it’s always wise to consider this in advance.

Even the most watertight schemes cannot protect against unexpected circumstances, and the older you get, the more difficult it can be to deal with unforeseen troubles.

While you can’t possibly be able to prepare for all eventualities, the earlier that you start, the more bases you can cover. Whether you are still working, or already retired, regularly checking your budget and investments for “leaks” can add significant monetary value to your plan over time.

Remember, retirement should be the time you are free to enjoy life, not to scamper around trying to scrape up enough money to get by.

Budget right

There are many things to consider as you approach retirement. But one of the most burdensome parts of any plan after retirement is budgeting.

This worry is only compounded by uncertainty over what expenses might arise — after all, who can predict the future?

According to a new survey from Capital Group, an investment management firm, the two biggest expenses for retiring baby boomers are healthcare and taxes. These two living costs have a tendency to spiral out of control. But they are just two of a number of expenses that are difficult to anticipate in retirement.

Healthcare costs

Forty-three percent of the retired boomers surveyed by Capital Group said that they were spending more than expected on health-care expenses. The huge potential cost of healthcare was confirmed by another 2015 study by HealthView Services.

They found that — excluding, dental fees, long-term care and over-the-counter medication — even a healthy couple of 65 years old could spend around $266,589 in supplemental insurance premiums and Medicare over their lifetime.

Inflation

Although inflation costs are currently at a low, they are unlikely to stay like this forever. It is important to factor in the possibility for inflation costs that could make your hard-earned savings less valuable.

While it might not cost you money, inflation can drastically reduce your spending power, so it is important to plan for potential changes.

Tax changes

Despite the fact that the United States has just seen big tax cuts, these new rates for individuals may not stay in place during the coming years, which makes planning for unexpected taxes important.

Three in 10 respondents to The Capital Group study said that they were spending more than they expected to in tax. Even though retirees might not be working anymore, their funds can still be taxed on withdrawal from an IRA or 401k account.

One way to manage tax levies is by moving to a tax-friendly locale.

Florida, for example, has no estate or income taxes. Wyoming also has no income tax, and at just 2 cents per gallon, has the lowest beer tax of all the U.S. states.

Travel costs

“Travel is the most popular activity for retirees, but it costs them more than expected,” said Lord of the Capital Group study. Four out of 10 retirees said that they were spending more than budgeted for on travel expenses.

Other retirees reduced their travel budget to help manage their cash flow, with thirty-five percent saying that they were not taking as many trips as they would like to.

Entertainment costs were also reduced, with many looking to spend time on activities that didn’t impact a tight budget.

If costs are higher than you had planned for, you’ll need a way to supplement your plan after retirement. That means working in some capacity, at least early in retirement.

A growing number of baby boomers are easing the transition into retirement by joining the gig economy.

According to a 2017 Prudential Financial survey, around 31 percent of gig economy workers are baby boomers, and 34 percent of those workers are retired.

The flexibility offered by contract jobs is attractive to retirees, allowing them to set their own schedule, and explore work opportunities in a range of surprising places. A study by insurance company Zurich surveyed 4,200 people on workplace culture and found that this flexibility is key to the appeal of the gig economy.

Jobs in the gig economy

The gig economy offers a surprising variety of jobs, meaning retirees from all walks of life can find a way to put their skills to use.

Ella Tyler, 67, found herself in need of some extra cash after her husband died. A former lawyer, she had given up the practice when she moved to Texas after getting married, but now found herself seeking extra work.

After noticing an advert for Law tutors with an online education platform, she jumped at the opportunity, and now gets paid up to $27 an hour to help students prepare for the Law School Admission Test.

She told CNBC how the opportunity has helped her get back in touch with her professional skills, and helped her regain confidence in her abilities: “As you get older, you wonder if you still have it,” Tyler said.

“And yes, I do. So there’s a little bit of an ego satisfaction to it.”

As the gig economy continues to grow, retirees have a larger pool of jobs to choose from — creating a higher chance that they will find a role that matches their time and resources.

Here are a few roles that might suit retirees in the gig economy:

Tutoring: Older people often have a wealth of untapped expertise. This could be from their professional life, or another interest. Sharing skills and abilities can help retirees fund their lifestyle and stay in touch with their passions. The gig economy offers more opportunities to teach flexibly — online or offline — than ever before.

Handyman: Anyone with a practical sensibility can find opportunities to help others with tasks like furniture assembly, decorating, or even shopping. Sites like TaskRabbit help connect those in need with willing workers.

Tour guide: For those with a passion for their local area, a job as a tour guide could let you share your interest with visitors to your locale.

Photographer: Online platforms such as Shutterstock allow you to sell photos for profit, which could be a useful income stream for those with a passion for snapping.

Driver: If you have the inclination and the equipment then you could find a job behind the wheel as a driver for taxi apps like Uber and Lyft.

What to tell the kids

As older adults begin to think about their plan after retirement, mounting concerns over financial planning, health, and lifestyle arrangements can push thoughts of family to the periphery.

But, one of the key aspects of a happy and successful retirement can only come from having a certain difficult discussion with your offspring.

Having a conversation with your kids about what life will look like in retirement might be uncomfortable, but is essential if you are both to be prepared for the future.

As CEO of Sensible Money Dana Anspach says, it is important to start these discussions early. “If you’ve established open lines of communication, it makes things easier in later years when cognitive decline can impact decision-making,” she says.

If retirement isn’t yet imminent, then you might want to consider exploring these two discussion points while you still have the chance.

Your financial legacy

A certain degree of privacy might have been maintained through your life, with children privy only to a general idea of your financial arrangements.

Whether you feel comfortable or not sharing this information, openness before retirement can make things easier further down the line.

“Be more open and honest with your kids about your financial information,” Joe Wirbick, president of financial planning firm Sequinox told US News, “that way the kids feel secure that Mom and Dad are OK.”

Laying out a clear plan after retirement will help to ensure a stress-free retirement for both you and your children. Intentions on living arrangements, health arrangements, and passing on your estate to your heirs should all be discussed.

Done properly, this will mean preparing and sharing several documents, including those that should be in place in the event that you become incapacitated.

This includes a health care directive, a durable power of attorney and a medical power of attorney

For some people it might also make sense to get a living trust drawn up, this will ensure your property and after-tax investment accounts do not go through the probate process when transferring from one generation to another, which could ultimately save thousands upon thousands.

Your children’s finances

Along with talking to your children about what they should do with your estate, you might need to take them off your own payroll!

If you’ve been paying your adult children’s bills for years, you may now need to withdraw this in order to retire. Or, even if they do not live with you, you might be burdened with the astronomical cost of college. This can force some prospective retirees to choose between funding their children’s education, and their own retirement.

In any case, its best to have a frank discussion about it early on. This way it doesn’t need to come as a shock, and a gradual game plan can be introduced to help them establish independence.

Maybe just run away?

Imagine waking up everyday for the rest of your life to new scenery, but every night coming back to the same familiar home. Sound intriguing?

Retiring on a cruise ship might seem like a pipe dream. But, actually, in comparison to the price of long-term nursing home care, living on a cruise ship might be more cost-effective plan after retirement!

Rhonda Day, vacation specialist with Vacation Days Travel in Louisville, Kentucky, pointed out that as long-term and nursing home care can cost more than $5,000 to $10,000 per month, you could budget a cruise ship for the same cost.

“Cruises include food, entertainment, onboard medical care, laundry facilities, a gym, constant companionship and much more. With the cost of living on land — taxes, mortgages, etc. — it may actually be more cost effective to live on a cruise ship.”

Stacey Hartmann, Travel Planner at Enjoy Vacationing in Waunakee, Wisconsin, agreed. She said that living on a cruise ship is completely possible, and that some of her clients choose to live this way in the winter instead of buying a second home in a sunnier clime.

What’s it like?

One lady living this opulent lifestyle full-time is Mama Lee Wachstetter, 89, who retired aboard a luxury cruise ship nine years ago so she might fulfil her passion for dancing.

Mama’s day might look quite different from the typical retiree. She wakes up late, has breakfast, stays on the ship. Then she takes a nap after lunch before getting her hair and nails done in the beauty spa. This leaves plenty of time for her to attend daily dance lessons, and enjoy entertaining herself with the professional male dancers whose only job is to dance with ladies on-board.

Mama is literally foxtrotting her way through retirement, but what is this plan after retirement costing her?

“I pay Crystal every six months in order to get the biggest discount,” she said, without revealing the exact amount she paid.

Penthouse suites on the crystal can cost around $306,345 per person for a 100 day world cruise, but her accommodation is more humble, and has been customised to fit her needs, with increased storage for clothes and jewellery.

If this way of life seems intriguing, remember that it won’t be free of challenges. Where will you get your mail and packages delivered? What will you do when you have ran out of new places to explore?

And more importantly, can you afford it?

For those who are serious about life on a ship, it might be wise to take a few long cruises beforehand just to get a deeper feel for the experience.