The De Beers cartel

Until the late 19th century, diamonds were extremely rare. A few pounds of diamonds a year were mostly sourced from Brazil and India for global demand. Only heads of state and royalty were known to flash expensive jewelry. This all changed by the late 1870s. Large diamond mines with plentiful supplies were discovered in Kimberley, South Africa.

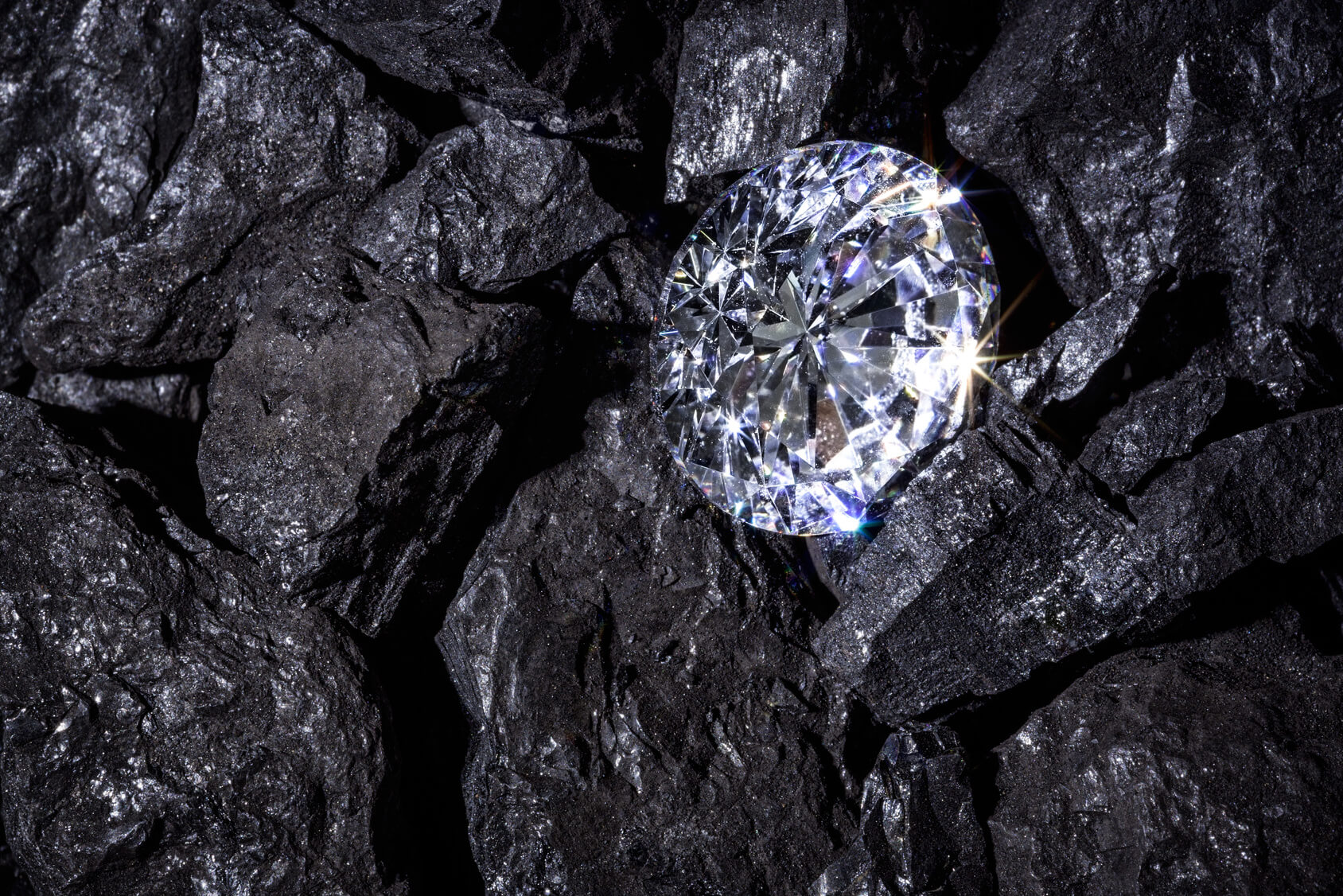

The inherent scarcity of diamonds is what made them invaluable in the early 19th century. The discovery of immense, South African diamond mines flooded the market like a tsunami. What was essentially invaluable decades earlier was now relatively worthless. If everyone can have relatively easier access to diamonds, why would they pay a lot for them?

The prices for diamonds fell sharply and stayed low for most of the early 20th century. During that time period, British entrepreneur Cecil Rhodes and an associated diamond cartel strategized how to make diamonds valuable again. Rhodes controlled all of the diamond mines in South Africa, essentially the global supply, by 1890. He then bought the De Beers mining company and worked with a select few other diamond companies.

The De Beers diamond cartel joined forces to create a monopoly and to strategically restrict supply to control prices. The De Beers cartel would buy out or crowd out other diamond companies that threatened their monopoly. Diamonds were then transported, sorted, refined, and cut at select distribution centers such as Antwerp, London, and New York City.

Business partners were then presented with diamonds as is. They could buy or walk. Retailers only had to pay for their diamonds from wholesalers after they were sold. De Beers thus gained 90% control of the global diamond trade through such tactics.