As I steadily increase my overall equity exposure to a measurable value bias, I do so using just three passive ETFs that are consistently near the top of their respective category rankings in Morningstar: Vanguard Value Index Fund (VTV), Vanguard High Dividend Yield Index Fund (VYM), and Vanguard Small-Cap Value Index Fund (VBR).

Using these three proven, solid and very formidable Vanguard ETFs can be an efficient and cost-effective way to build out value equity exposure within your total investment portfolio.

Vanguard Value Index Fund (VTV)

Vanguard Value Index fund (VTV) is an excellent vehicle for obtaining large-cap value exposure in a very efficient manner. With an overall expense ratio of 0.04%, well below the category average as well as the fee level for overall mutual funds and ETFs, this fund has placed in the top first or second quartile over the past one, two, five, 10 and 15 years.

While large-cap value makes up around 85% of the fund, mid-cap accounts for the remaining 15%, so investors do get some exposure to smaller companies. Given the heavy value tilt, sector overweights (versus the S&P 500) are where you would expect: Financials, Healthcare, Consumer Staples and Energy.

Underweights are in Technology, Consumer Cyclicals, and Communications Services. Turnover is nice and low at only 12% per year. The portfolio managers determine value based on price/book, price/earnings, dividend yield, and price/sales.

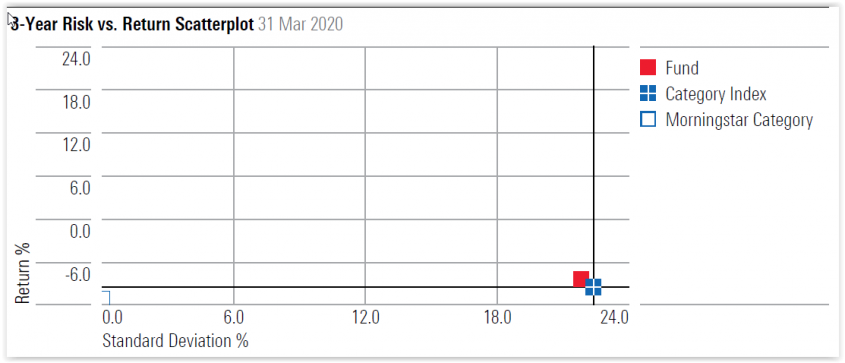

A three-year risk versus return scatterplot for VTV is shown below. As seen, the fund is in the prized “northwest” quadrant, with returns above the category average but with risk (i.e., standard deviation) below the category average.

Vanguard High Dividend Yield Index Fund (VYM)

Vanguard High Dividend Yield Index Fund (VYM) is in large part an extension of my large-cap value exposure via VTV above, but with the obvious additional constraint of a greater than normal current dividend yield.

The Vanguard portfolio management team ranks stocks by dividend yield and selectively adds names to this portfolio until roughly half of the dividend-paying universe’s market capitalization is captured.

Total holdings end up fairly large at around 400 stocks, but nearly one-third of the assets are held by the 10 largest positions. As with VTV, operating expenses are extremely low at 0.06%, compared to an average fee of approximately 0.85% for its peer group.

This is predominately a large value fund as well, but like VTV you get some mid-cap value exposure (11%) and even some small-cap value exposure (3%). The trailing 12-month dividend yield is right around 3.1%, nearly 150 basis points above the overall market dividend yield.

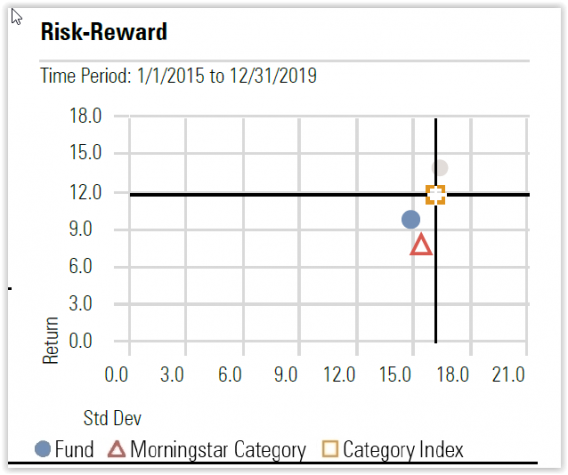

A similar risk-reward scatterplot for VYM over the past five full years is shown below. As with VTV, the fund resides in an area northwest of its Morningstar category bogie, with annualized returns of 200 basis points higher and standard deviation (risk) 100 basis points lower.

Vanguard Small-Cap Value Index Fund (VBR)

Vanguard Small-Cap Value Index Fund (VBR) is my go-to fund to augment the above large- and mid-cap value allocations with small-cap value. As with the other two funds described here, VBR combines razor-thin expense ratios (seven basis points) with solid portfolio management to generate returns that have been top-quartile over the past three, five, 10 and 15 years.

Consistent excess returns over the category average have been generated for many years, despite holding nearly 800 names, which would tend to make a portfolio more benchmark-like. Higher weighted sectors are where you would expect for a small value portfolio: Financials, Consumer Cyclicals, Industrials and Real Estate.

The average market capitalization for VBR is noticeably higher than the average small-cap value fund at $3.5 billion versus $1.6 billion. In fact, Morningstar shows nearly 50% of fund assets to be in the mid-cap value space.

Because of this, I choose to simply use VBR alongside VTV and VYM and I do not add an additional fund for direct mid-cap value exposure.

The three-year return versus risk scatterplot for VBR is shown below. Once again, as with VTV and VYM, the fund lies well northwest of its Morningstar category average, with nearly 280 basis points of excess return and 200 basis points less standard deviation (risk).