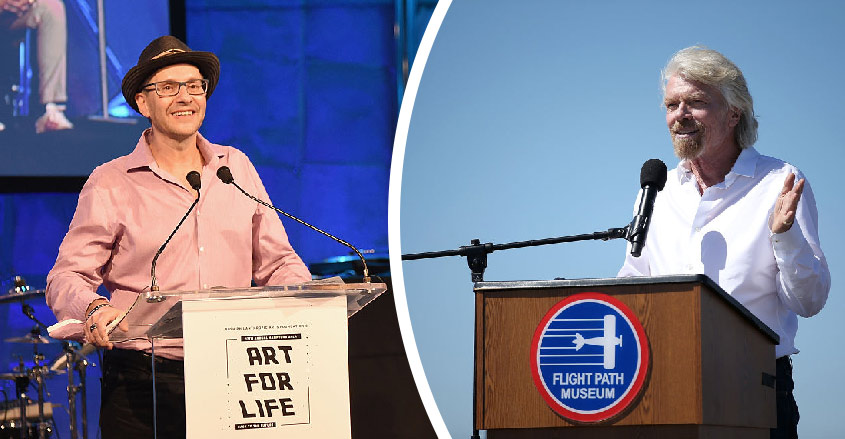

The flamboyant founder of the Virgin Group in the UK, billionaire Richard Branson, is making an entry into private equity for the first time.

Branson has joined with $2bn London-based Metric Capital to create an investment vehicle that will make targeted PE investments in consumer businesses.

Branson plans to raise $500 million from institutional investors worldwide to fund this move.

The Financial Times, which spoke to people familiar with this development, said that Branson intends to pursue “consumer deals of up to two billion euro in enterprise value.”

John Sinik, Metric Capital’s founder, and Branson have known each other for a long time. They will create a new fund where Branson will become a partner, and Metric will co-manage it.

Branson issued a statement saying that he has been impressed with the growth and development of Metric Capital.

The firm’s experience in the fast-changing digital and consumer markets particularly attracted Branson, and now he is ready to work together with John and his team to promote this new private equity fund.

Metric Capital aims to capitalize on the high visibility and international recognition of Branson for this ambitious fundraising and investing endeavor.

Having established Virgin Records nearly half a century ago, Branson rapidly built a global conglomerate that now includes a highly successful airline, a train company, a bank, a beverage company, and several other businesses.

The popularity and connections of Branson should help the fund achieve bigger deal flow, and that is what Metric seems to be targeting in this synergistic partnership.

Branson’s private equity move comes just two days after he unveiled a grand vision for a hyperloop-connected world that will see goods shipped instantly anywhere in the world “at the speed of flight.”

Real estate down under

Meanwhile, billionaire small- and medium-cap stock investor Alex Waislitz, popularly known as “Australia’s Warren Buffett” has just announced a big property move.

Waislitz is planning to launch a listed property fund that will be modeled after his investment firms Thorney Technologies and Thorney Opportunities.

Although Waislitz has earned a fortune from investing in the Australian stock markets in the last few years, he has been gradually shifting focus to real estate.

His private investment group, Thorney, has already backed a few real estate developers by lending them about $20 million, which he now plans to increase to over $100 million. This will correlate with more jobs as well.

Moreover, according to Australian Financial Review, Waislitz plans to expand his investments in real estate through an unlisted fund or a new listed investment firm.

His company Thorney has also partnered in property syndication deals of more than $1 billion across residential, commercial, and industrial real estate in the last few years.

With a diehard entrepreneur such as Branson and a master stock investor such as Waislitz turning to alternative investing in a big way, it is likely to attract the attention of more global billionaires to consider targeted investments in private equity and real estate.