Noted economist and longtime stock bull Jeremy Siegel is urging caution in the waning bull market.

Siegel, finance professor at the Wharton School and author of Stocks for the Long Run, correctly predicted the Dow Jones Industrials would hit 24,000.

In late 2017, Siegel also correctly predicted the Dow hitting 20,000. The Dow at this writing was trading intraday at around 24,611, up 195 points from the open.

Siegel now appears to be straying from the bull camp, however. He cites risks from rising interest rates to trade tensions as the reasoning behind his new prediction.

“The major threat of the market is higher interest rates going forward,” he said.

“Too many people read the FOMC minutes as being too dovish.”

Siegel expects the Federal Reserve to raise rates four times this year. He has previously expressed concern over a quickly changing monetary policy.

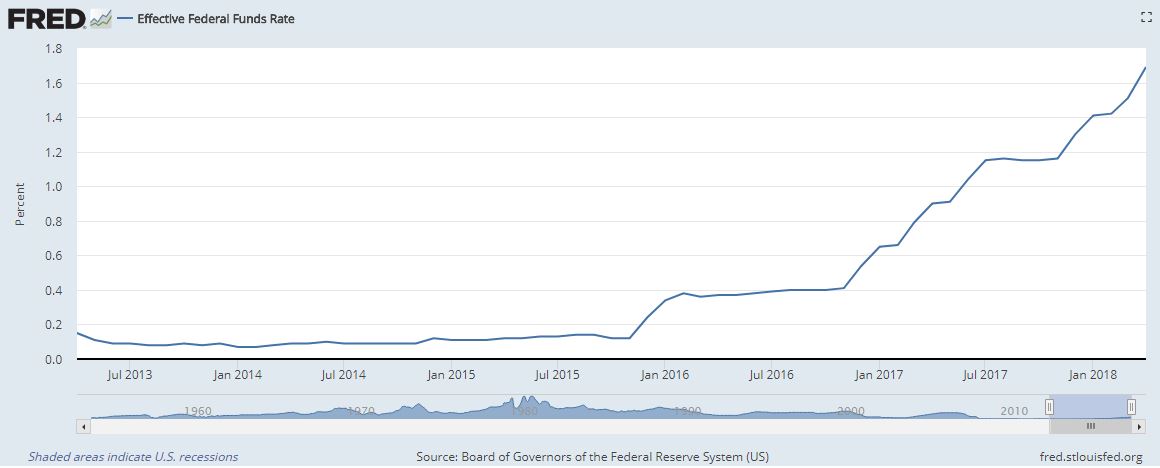

The Federal Reserve benchmark interest rate, the federal funds rate, is at 1.75 now. It had been at nearly zero since the 2008 crisis and finally began its recent ascent in late 2015.

Siegel is still a fan of stocks, of course. But he worries what might happen if the Fed has to admit to tightening too fast.

“Is the Fed going to be much more aggressive as that unemployment rate keeps on going down? Will they have to tighten? And that will definitely put a pause.”

The U.S. economy added 223,000 jobs in May, pushing the unemployment rate down to 3.8%.

Most economists have long considered 5% unemployment as “full employment” in the United States and a signal that rising wages and inflation are on the way.

Siegel also is concerned about politics.

“How will the Republicans do in the midterm elections? Will they hold the Senate? Will they hold the House? That’s why it’s more urgent go get what you think is right done now.”

Siegel has rising tensions with China on the mind, too. “[President Donald Trump] feels he has to tread very, very carefully on this. It doesn’t mean for sure he won’t go full blast forward,” he said, referring to trade negotiations.

“Caution is going to be the word here.”

Siegel has repeatedly warned that 2018 will not be as profitable as 2017, though he says he sees no signs of the economy slowing down.

Earnings run

Another one of Siegel’s predictions is that stocks will be flat this year — or up by 10 percent by year-end.

“This is a great year for earnings, no one argues with that,” he said.

“But the tax cut is front-loaded which means that the write-offs on capital equipment are going to accrue to 2018 and not nearly as much in 2019.”

Siegel’s views come a day after stocks were able to come back from political tensions in Italy that rocked the global market.

The problems in Europe erupted after the country’s two largest parties, the left-wing 5-Star Movement and the right-wing League, tried to appoint an anti-European Union politician as finance minister.

This was vetoed by the country’s president, Sergio Mattarella, who then then appointed a new euro-friendly prime minister.