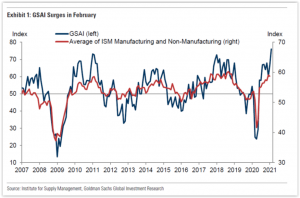

Amidst all of the nerve-wracking market volatility in recent days, some good therapy may be to refocus on business fundamentals and the state of our economy. Refer to the chart below.

I come across many business and economic indicators in the course of my investment and financial market research, but I find the Goldman Sachs Analyst Index (GSAI) shown above to be one of the most comprehensive.

The indicator encompasses sales and shipments, orders, inventories, output prices, exports, wages and labor costs.

Similar to the more familiar government’s purchasing managers index, a score above 50 signals expansion, while a score below 50 indicates contraction.

As seen, we are at a 14-year high on this indicator, eclipsing the prior peaks in 2011 and 2018. And we are clearly above the level just prior to the COVID-19 pandemic in February and March of last year.

Core economy

In fact, if you delve into the tabular data that supports the above chart, which I will not bore you with here, important subcategories like “Companies’ sales and shipments” are scoring over 90 and “Raw material prices” are at around 80, both very high scores and well above the critical 50 level.

In my view, this is all reflective of very solid strength for the state of business in the U.S. currently. The question of how much of this is already sufficiently reflected in the financial markets is a different topic for another article.

Suffice it to say, there is core strength in the U.S. economy at the present time.

The economy is alive and well folks. When we go through extreme market gyrations like we have just witnessed in recent days, it often helps to remind ourselves of this important fact.

Onward and upward!