After you have been living in your home for a while your income tends to grow but your mortgage stays the same.

You may find yourself having extra money each month. There are many avenues you can take. You can put it in a college savings account for your kids, upgrade to a newer house or put it a savings investment.

Or, you can invest in stocks, which are likely to grow at a much quicker rate than a bank savings account.

Many people choose to accelerate their mortgage payments, with the idea of buying stocks later.

But should you pay off your mortgage before starting to invest in stocks or other investments? Paying the house off certainly will save you money by reducing the interest you pay.

But is that the best use of your investment dollars?

Much depends, of course, on your comfort level with the ups and downs of the stock market. But you can earn significant returns in the market.

Even if you just invest in an exchange-traded fund (ETF) that follows the Standard and Poor’s 500 Index, like the SPDR S&P 500 ETF Trust (SPY).

Scenario 1: Bye-bye mortgage

If you choose pay off your mortgage, your savings would be substantial.

Let’s say you own the median-priced home in the United States for $295,300 and have a 3.92% interest rate 30-year mortgage.

Your principal and interest would be right about $1,396 for an overall mortgage cost of $502,640. A 30-year mortgage at that rate will wind up paying approximately double for the house over the life of the loan.

After 10 years of payments your principle has dropped to $202,000. As the loan matures, more of your payment goes to the principal and less to interest.

At that point, paying an additional $500 per month on your loan you would save $38,043 and knock six years, 11 months on your remaining mortgage.

Scenario 2: Investing in stocks

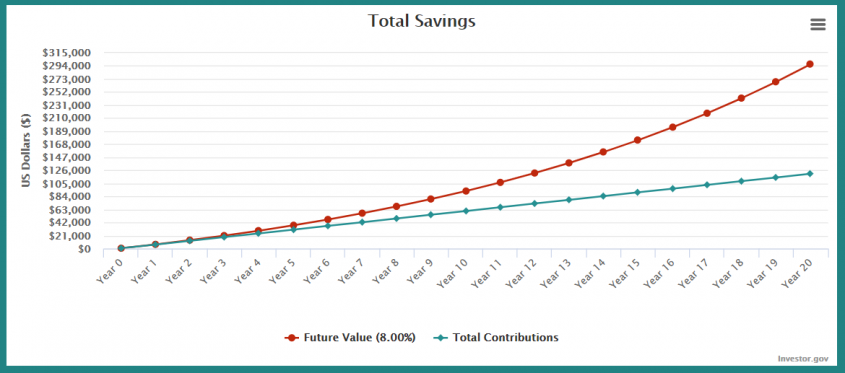

So what if you take that same $500 and invested it in SPY or some similar, broad-market index fund?

Since 1960, the S&P 500 has returned an average of 8% per year. In the year 2020 the index returned 15.76%, even with the 34% drop in March.

Assuming you can deal with occasional drops in the market (and sometimes drastic ones) and you never got anything better than the typical 8% long-term return, at the end of 20 years you would have $296,973.

That’s more than you originally paid for your home.

This money combined with your paid-off home equity — assuming real estate doesn’t appreciate in value, which of course it does — and you will have more than $500,000 in assets for retirement, starting a business or anything else you choose.