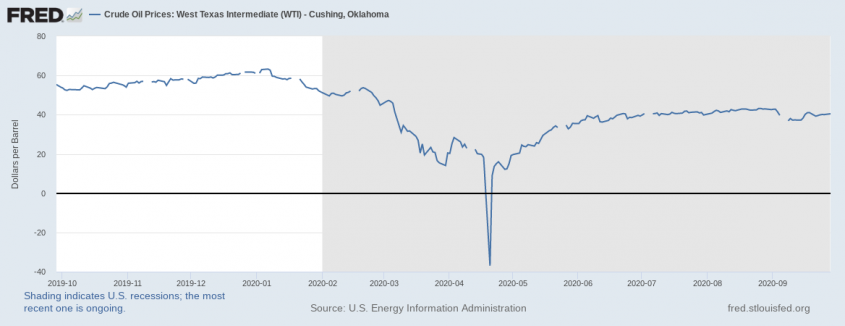

Oil has been down since late February 2020 and even was going to negative $37.63 per barrel in April for a short time.

While oil has risen since then, it has been trading in a very narrow range between $34.50 and $43.69 since June. With oil trading sideways, it allows for an outstanding put selling opportunity and a way to earn some excellent income.

With government agencies loosening restrictions, people going back to work, students going back to school, and with travel increasing, there are some good indicators that this may be a good time to get into the oil market.

In addition to these economic indicators slowly inching up, the Dallas Fed recently conducted its quarterly energy survey. The survey asked 166 energy firm executives where oil prices will be going forward in the coming six months.

The average price from the survey was $43.27 per barrel by year-end 2020, with responses ranging from $30 to $60. This is another good signal for options traders because the consensus is that the price will basically stay in a range.

We are on the verge of oil’s weakness ending and the beginning of an advantageous selling opportunity.

Trading oil futures has an extremely high buy-in cost. Oil futures are sold in increments of 1,000 barrels.

You can participate in trading oil with an alternative by using the United States Oil Fund ETF (USO). The range for USO has been $25 to $31 during the same time period starting mid-June, which is even tighter.

This permits you to secure the contracts for far less than that of a futures contract because you will be working in increments of 100 shares.

Alternative to futures

Another way to take advantage of the situation in WTI Crude is to write (sell) uncovered puts. With most brokers, you will need to have an authorized trading level to sell uncovered puts.

Otherwise, you can only sell cash covered puts. If your broker doesn’t allow you to use naked puts you will be required to set aside the cash to cover your contract in case it drops and you are assigned.

You should never get assigned because you will either buy-to-close (BTC) your position or roll it out to another month at least seven days before expiration.

Rolling allows you to BTC your current position and sell a new position in another month as one transaction. If you can set up the right trading level with your other brokers you can sell naked puts, which will decrease your buying power requirements by using margin.

You have to be careful that the underlying doesn’t drop too far or you will get a margin call. But, just like cash covered puts, you can avoid any situation that would require a margin call either rolling or closing.

With put selling, unlike the opposing call buying transaction, you want the underlying stock to either increase or go sideways. When you buy a call, you only make a profit if the underlying goes up.

This is no better than buying a stock and hoping that it goes up. Because of continued uncertainties across all sectors of the economy, implied volatility is elevated, which is a function of investors paying people like us for insurance to cover their long (bought) stock positions.

Implied volatility isn’t outrageous, but the higher level helps increase the price of the puts because there is more demand for the protection. These are good conditions for selling puts.

As an investor, having two alternatives in order to make gains on a position is primary. We are looking for the price of the option to drop over time, either by the price of the underlying going up or time running out as the price ranges.

The oil market will probably continue sideways for the next few months, but as the economy moves closer to normal, we will start seeing increased prices as demand grows.

Either way, prior to the increase and after, you can go 30 days out to earn a very reasonable 3% per month return selling slightly out-of-the-money puts.