How are corporate balance sheets overall after nearly 12 months of the pandemic? They may be better than you would intuitively think.

I show some charts below that addresses this question to a degree.

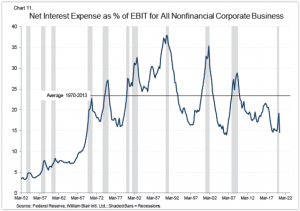

Shown in the chart above is the ratio of net interest expense relative to earnings before interest and taxes. Right now, this ratio is well below its average since 1970, and is in fact at its lowest reading since 2006.

This would indicate few problems here insofar as companies’ abilities to service their debt costs through their cash flow. Certainly, the very low interest rates are a major enabling factor here.

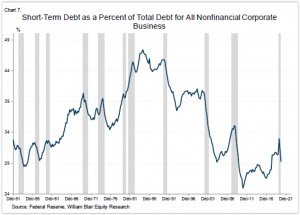

How about the outstanding maturity of the debt on corporate balance sheets?

The chart below shows that short-term debt as a percentage of total debt is still very low. As rates have dropped, companies have been very proactive in extending out their overall duration.

This is a good thing from a corporate finance standpoint, as it levels out the schedule of debt coming due and it gives firms more breathing room to address all of their capital financing needs.

Lastly, we look at asset liquidity. Below is a chart showing the quick ratio, which is defined as all liquid assets (typically cash plus short-term liquid investments) divided by short-term liabilities.

A quick ratio value of 1.0X is pretty good, and as seen in the chart we are up to that level right now. We are well above the long-term average of approximately 0.6X to 0.7X.

In summary, U.S. corporate debt has increased quite a bit over the past few years. In fact, it is at nearly 100% of total GDP, at the high of its historical level.

But many ratios such as those shown above still look very good. Corporate balance sheets in aggregate are generally solid currently, even after nearly 12 months of a pandemic-induced recession.

The obvious risks to this more favorable picture going forward are things such as higher interest rates, rebounding bankruptcies, a renewed COVID slowdown, etc. These are all macro factors worth keeping an eye on over the next several months.