-

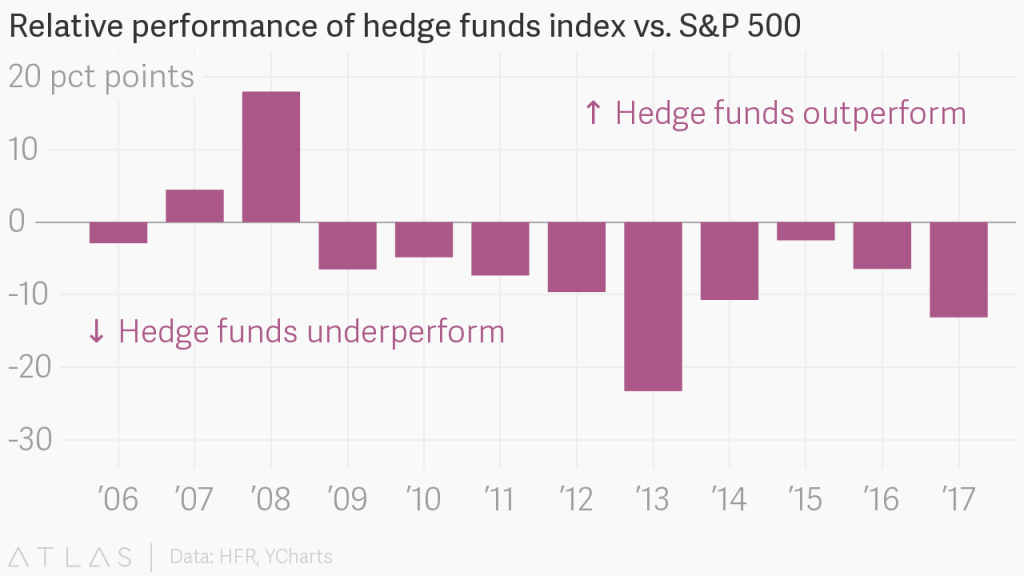

Hedge fund investing can be a way to earn a positive return in a down market.

-

Nevertheless, in bull markets hedge funds have underperformed in recent years.

-

Hedge fund of funds can reduce risk but add complexity to your portfolio.

Unlike a mutual fund, hedge fund investing aims to deliver what are called “absolute returns” regardless of the direction of the stock market.

Hedge funds typically avoid registering with the Securities and Exchange Commission (SEC), which gives them more leeway than a normal stock mutual fund to conduct a more aggressive trading strategy.

However, as the financial markets have continued to evolve rapidly over the last decade, led by computerized modeling and complex algorithms, things have become particularly challenging for hedge fund investing.

According to the famed hedge fund manager Stanley Druckenmiller, the “algos” have created disruption and taken out the rhythm from the stock markets.

Benefits of investing in a hedge fund

If you are an investor with an appetite for higher risk and an ambition to achieve higher rewards, hedge fund investing could still be an attractive proposition. Another reason for some investors to choose hedge funds is portfolio diversification.

In addition, bear markets present a lucrative opportunity for hedge funds.

- YES, sign me up! Market-destroying trades for serious short-term investors that crush the indexes in days, not months or years!

Hedge funds are often built around star hedge fund managers. Therefore, choosing the right manager is the key to making money through hedge fund investing.

Timing is of essence too. According to figures published by Credit Suisse, from 1994 to 2018, the S&P 500 index fund outperformed all major hedge fund strategies in terms of annual returns. But some strategies performed well.

For instance, short strategies failed between 1994 and 2009, but market neutral hedge fund strategies outperformed the passive S&P.

If the market trends are bullish, it seems that hedge funds will struggle to beat the S&P 500.

On the other hand, in bearish markets, hedge funds could turn out to be a more lucrative asset class than long-only or buy-and-hold mutual funds.

Furthermore, hedge funds of the advantage of diversifying your portfolio.

Large investors often choose hedge funds to reduce risk by increasing portfolio diversification. If you add positive-returning but uncorrelated assets to your investment portfolio, it can bring down the overall portfolio risk.

Since hedge funds employ short sales, derivatives, or non-equity investments, they are usually uncorrelated with the broad index trends in the stock market.

However, the degree of correlation will vary according to the hedge fund manager’s strategy.

The downside of hedge fund investing

As a hedge fund investor, you are more likely to have exposure to multiple risks compared to a mutual fund investor. Every hedge fund strategy will present its own set of unique risks.

For instance, short/long funds are exposed to the risk of a short-squeeze, a situation where a substantially shorted stock moves up sharply, compelling short sellers to close their short positions.

In other words, the short sellers are “squeezed out” of their positions, often at a loss.

Research has shown that hedge funds are surprising less volatile than the rest of the market. While volatility is a traditionally accepted measure of risk, this does not mean that hedge funds present lower risk.

The problem with hedge fund returns is that they do not follow the path of symmetrical returns that traditional volatility implies.

Hedge fund investing returns usually are more skewed. In fact, they tend to be more negatively skewed.

This means they are characterized by positive returns most of the time but also present a chance of extreme losses.

To borrow from Warren Buffett, this can be described as a game of Russian Roulette where you “usually win, but occasionally die.” Clearly, that’s a dangerous game to play for someone who doesn’t have the appetite for it.

Considering this peculiarity of hedge fund investing, risk evaluation should focus on the downside risk rather than volatility.

A downside risk measure, such as VaR (value at risk) would answer tough questions, such as: “What is the probability that I will lose 20 percent of my investment in 12 months?”

Fund of hedge funds

Funds of hedge funds have gained popularity in recent years because they avoid the concentrated risk of investing in a single hedge fund.

Funds of hedge funds are essentially pooled funds which allocate capital between multiple hedge funds. Such a fund will typically have 15 or more different hedge funds in the pool.

Unlike individual hedge funds, these funds of funds usually are SEC-registered. These funds are more amenable to retail investors and their income and net worth tests could be lower than usual.

The advantage of choosing a fund of hedge funds is that your investment gets widely diversified and you get the benefit of fund selection expertise and monitoring efficiency.

Diversification ensures that failure of one hedge fund will not destroy the whole investment.

- Exclusive Access: Get Keene Little’s Crypto Wealth Protocol delivered to your inbox!

Funds of hedge funds perform due diligence to ensure that their exposure is restricted only to the most reputable hedge funds. These fund pools are known to be good at discovering talented hedge fund managers.

In fact, their business model is to a large extent based on identifying the top performing managers and reducing exposure to the underperforming managers.

The primary disadvantage of choosing a fund of funds is the cost. The nature of this fund is such that it creates a double-fee cost structure.

You end up paying the management fee to the fund of funds, and perhaps even a performance-based fee, apart from the fee that is typically paid to the pool’s underlying hedge funds.

While the fee structures could vary, you can expect to pay about a 1% management fee to the fund of funds as well as the underlying hedge funds.

Another downside that is often overlooked with funds of hedge funds is the risk of over-diversification. The fund of funds must be agile enough to efficiently coordinate and manage holdings or it can fail to deliver value.

Unless careful selections are made, the fund may end up with multiple hedge funds that duplicate holdings, or worse still, inadvertently become a representative sample of the overall market.

Is hedge fund investing for you?

If you intend to invest with a hedge fund, you should first assess the past track record of the hedge fund manager and see how consistently they have delivered returns over a number of years.

In addition, choose a reputable fund of hedge funds to diversify your risk, while aspiring for market-beating returns.

If you can’t do the due diligence work on your own, hire an investment advisor who is qualified to do so. If you can’t afford the fees and the due diligence, perhaps hedge fund investing is not worth the risk to your portfolio.